Financial data management is more than just keeping track of numbers—it’s the backbone of making smart decisions that drive a company’s success. But let’s be honest, managing financial data isn’t easy and can be a real headache. It’s a constant challenge with hurdles like data inaccuracies, security breaches, and complicated data integrations. These challenges can make it tough to keep everything running smoothly.

A Gartner study found that 54% of finance organizations still struggle to provide data that stakeholders can trust for making informed decisions. This shows just how important and challenging effective financial data management really is.

In this overview, we’ll explore what data management is in the finance industry, why it’s important today, the challenges businesses face with it, the data management services that can make your financial data more valuable, and the key trends that are shaping its future.

What Is Data Management in the Finance Industry?

Financial Data Management (FDM) is a set of processes and procedures used by organizations to collect, measure, organize, analyze, and manage their financial information. This practice involves using specialized tools and software to ensure that financial data is accurate, accessible, and compliant with regulatory standards.

FDM helps businesses improve operations and performance, making it easier to produce detailed financial reports and maintain compliance with accounting rules and regulations.

Why Managing Your Financial Data Should Be a Priority Today

The main reason your financial data should be a top priority is that the financial industry affects every other industry. It’s where all currency is exchanged, and without solid financial management, everything else can quickly fall apart. But that’s just one piece of the puzzle—there are plenty of reasons why you need to make this a priority. Here’s why it matters so much.

Regulatory Compliances

We all know compliance can be a hassle, but it’s something you can’t ignore when running a business. Keeping your financial records correct and up to date isn’t just something you do because you have to. Rather, it’s something you do to protect your business and is a requirement for passing audits and avoiding penalties.

For example, the Sarbanes-Oxley Act requires companies to maintain accurate financial data and report it correctly to prevent fraud. Failing to comply with these regulations can lead to hefty fines and damage to your reputation. By effectively managing your financial data, you align it with regulatory requirements, which lowers the risk of non-compliance.

Risk Management

When you have a clear and complete view of your financial data, you’re in a much better position to spot and manage risks tied to things like investments, loans, and other financial decisions. Think of it as a roadmap that guides you through all the bumps and curves in the financial world.

Financial institutions use financial data management systems for advanced reporting and analytics to analyze transactional data, market trends, and other relevant data to predict and manage risks–anything from credit risks to market fluctuations to internal operational challenges. According to a MicroStrategy report, 56% of companies use analytics and data to improve their risk management and make smarter decisions, and 51% use it to drive better financial performance.

Data Quality and Integrity

Quality financial data is a must to keep a business on track. Without it, you’ll end up with financial reporting mistakes, incorrect risk assessments, and flawed decisions. According to APQC, 93% of finance teams use analytics and data for key performance indicators (KPIs) and forecasting. Learn more about the essential finance KPIs that drive profitability and growth. It’s expected that most organizations like yours will heavily invest in data governance this year to maintain data integrity and protect the company’s assets.

Operational Efficiency

When financial data is well-organized and accessible, it makes everything run smoother. Think about the time you could save when tasks like reporting, auditing, and analysis don’t eat up your entire day. Plus, AI and machine learning are now handling complex tasks for you.

These are used to automate tedious parts of data management, so you spend less time buried in spreadsheets and more time focusing on what really matters. Aside from that, using automated data platforms can spot and stop data breaches 108 days faster than those without such systems, potentially saving millions of dollars.

Customer Satisfaction

Customer satisfaction is directly related to how an organization handles their customers. That’s a no-brainer. The better you know them, the better you can serve them. By analyzing their data, you can personalize the services that make them feel like you truly get them, not just like they’re another number in your system.

Accurate data also means that you can resolve their issues faster and more effectively, building trust that can turn into loyalty. Loyal customers are more likely to stick around and even spread the word about your business.

Cost Reduction

Good financial data management can save your business a lot of money. By using financial data management systems, you can dodge those expensive mistakes that can come from manual processes. Automating routine tasks cuts down labor costs and improves efficiency at the same time.

Think about this: businesses implementing effective data management practices can reduce operational costs by as much as 20%. For example, using cloud-based data management systems for storing data means you’re only paying for the storage you use, not a bunch of storage space you don’t need. With automation tools that take care of repetitive tasks like data entry, organizations can focus on bigger, more strategic projects. That means less money wasted on fixing errors and more time spent on things that drive your business forward.

Security and Privacy

With cyberattacks becoming more common, especially in the financial industry, it’s no surprise that nearly 80% of financial leaders admit they’re worried about their organization’s vulnerability to these threats. And this concern isn’t just overblown—ransomware and data breaches are happening more frequently and costly.

Over half of all organizations have suffered a data breach in the last year alone, and another 51% have dealt with ransomware. These numbers aren’t just statistics–they show how common and dangerous these threats are and serve as a clear sign that managing your financial data securely needs to be a top priority.

Smooth Integration

If you don’t have the right integration in place, you could end up with data silos. This disconnect can lead to inefficiencies, mistakes, and frustration. But when you invest in advanced financial data management solutions, you can avoid these pitfalls. Your team can access and analyze a fully consolidated view of data, which could lead to quicker, smarter decisions because everyone is on the same page.

Future-Proofing

Future-proofing your business is all about being ready for what’s next. With the constant evolution of technology and increasing cyber threats, you need to adapt quickly. Financial institutions that prioritize having solid data management practices are better positioned to handle whatever comes next in the future.

A study found that by 2031, the cost of cybercrime, like data breaches, could hit $265 billion annually. This serves as a wake-up call to prioritize financial data management now, as it is like building a strong foundation for your business—it keeps you stable today and prepares you for whatever challenges the future may bring.

Top Data Management Trends Shaping the Future of Financial Services

The financial services industry is undergoing rapid transformation, driven by technological advancements and evolving regulatory landscapes. Staying ahead of these trends is crucial for businesses looking to maintain a competitive edge and enhance their operational efficiency. Here are the key data management trends that are set to redefine the financial services sector:

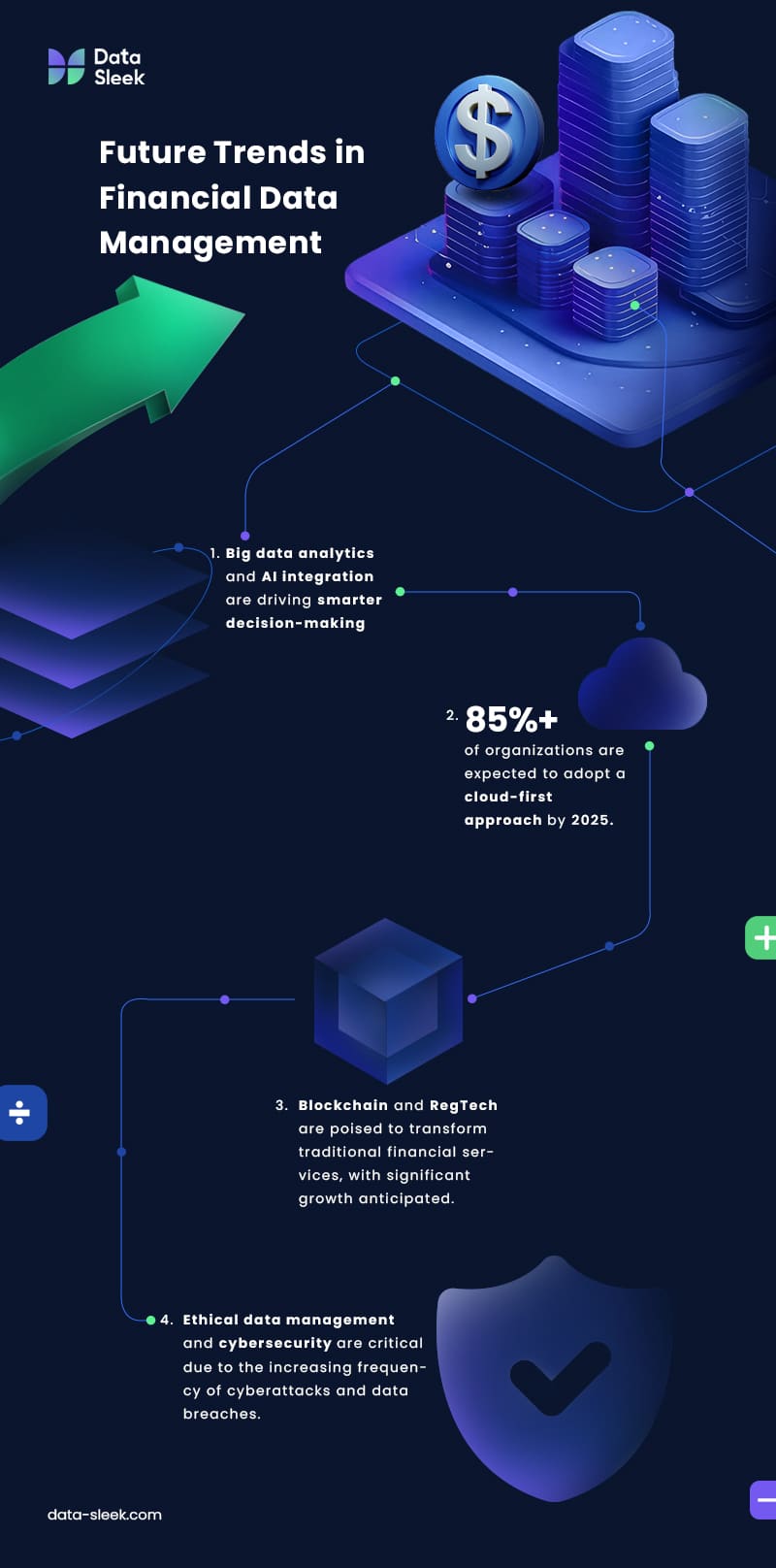

Big Data Analytics and AI Integration

Big data analytics remains at the forefront of financial services, with its market expected to surge from $307.52 billion in 2023 to $924.39 billion by 2032. This growth is fueled by the increasing demand for real-time insights, particularly in financial forecasting and risk management. As the industry shifts toward intelligent automation, it’s anticipated that by 2025, 80% of companies will incorporate big data analytics into their operations, enhancing efficiency, personalizing customer interactions, and optimizing supply chains.

In parallel, AI and machine learning (ML) are revolutionizing financial institutions. Banks and other financial organizations are heavily investing in AI, with spending expected to more than double to $97 billion in 2027. These technologies are not only automating complex tasks but also enabling predictive analytics, enhancing risk management, and streamlining compliance processes. AI-driven tools, such as dynamic modeling and AI-powered chatbots, are allowing finance teams to make faster, more informed decisions while reducing manual workloads and improving accuracy.

The Rise of Cloud-Based Data Solutions

Cloud technology continues to dominate the financial services landscape, with over 85% of organizations expected to adopt a cloud-first approach by 2025. The benefits of scalability, flexibility, and cost-effectiveness make cloud-based data storage an essential component for modern financial institutions. As companies increasingly rely on hybrid and multi-cloud environments, they can manage their data more efficiently, support remote work, and enhance overall performance and customer experience.

Real-time data processing is another critical trend, enabling financial institutions to make instantaneous decisions and respond to emerging risks. The ability to process large volumes of data in real-time, powered by AI systems, allows firms to quickly identify and mitigate potential issues, such as suspicious transactions or regulatory compliance lapses.

Blockchain and Regulatory Technology

Blockchain technology is poised to disrupt traditional financial services, particularly through decentralized finance (DeFi) applications. By eliminating intermediaries, blockchain can reduce costs, accelerate transactions, and enhance security. While the technology is still in its early stages within mainstream finance, its potential to transform processes like clearing and settlement could result in significant industry savings, which currently cost the industry over $130 billion each year. However, widespread adoption will require overcoming challenges related to scalability and standardization.

Regulatory technology (RegTech) is rapidly gaining traction as financial institutions seek more efficient ways to navigate complex regulatory environments. The RegTech market is expected to grow from $12.37 billion in 2023 to over $30 billion by 2027, showcasing explosive growth. Leveraging AI, blockchain, and cloud computing, RegTech solutions automate compliance tasks, reduce costs, and minimize human error. As the RegTech market grows, more financial firms are expected to invest in these technologies to stay ahead of regulatory demands and ensure robust compliance frameworks.

Ethical Data Management and Cybersecurity

As data privacy concerns intensify, ethical data management has become a priority for financial institutions. Companies are increasingly focusing on transparent data governance practices, ensuring that data is collected, stored, and used responsibly. This shift not only helps in regulatory compliance but also builds trust with customers, leading to long-term benefits in customer loyalty and brand reputation.

Cybersecurity remains a top concern in the financial services sector, given the rising frequency and severity of cyberattacks, with a 75% rise in data theft extortion cases last year alone. In 2024, the emphasis is on adopting advanced cybersecurity measures, including AI-driven threat detection, zero trust architectures, and enhanced digital identity protections. As the threat landscape evolves, financial institutions must continue to invest in robust cybersecurity strategies to safeguard their data and maintain customer trust.

Ethical Data Management in the Financial Industry

When running a financial institution, effective data management isn’t just a box to check—it’s your frontline defense. Your customers are counting on you to protect their most personal and sensitive data, like their Social Security numbers, bank account details, and even their financial habits. This trust isn’t just given; it’s earned by proving that you can keep their data safe.

But what happens if that trust is broken? Consider the effects of a massive data breach involving National Public Data in the United States. Such is a nightmare scenario—almost all U.S. citizens have suffered a breach that affected approximately 2.9 billion records. This exposure included critical such as names, addresses, and Social Security numbers.

Millions of records are now readily accessible on the dark web and susceptible to the potential for identity theft and fraud. The short term effects of this scenario go farther beyond distrust in the financial industry. The long term effects, on the other hand, can be disastrous.

What To Do In Case of A Financial Breach

So, what should you do if—or when—something like this happens? In situations like these, your institution becomes the first line of defense. Organizations hold a responsibility to quickly alert your customers if their data has been compromised. Beyond notification, it’s also their responsibility to take immediate action to protect the customer.Protection could mean closely monitoring for signs of fraud, guiding customers on what to do next, putting measures in place to stop further breaches, and working closely with law enforcement and regulators.

The best line of defense is taking a proactive approach. Effective data management is your best and strongest defense against breaches. Encrypting data, staying on top of the latest security protocols, and regularly running risk assessments can make your institution a tough target. And if a breach does occur, despite the best efforts, handling it transparently and swiftly can help you keep your customers’ trust and avoid long-term damage to your brand.

Case Study – Digital Asset Research Battles Data Management Challenges

Digital Asset Research (DAR) is a digital currency reporting agency known for providing highly accurate and reliable data to major financial players like Bloomberg and FTSE Russell. DAR’s primary challenge was handling the massive volume of data it ingested daily—over 40 million rows from 250+ million real trades across more than 7,000 digital assets.

This huge data load led to sky-high management costs, frequent system outages, and errors in data processing that threatened the accuracy of their reports. Their existing data system just couldn’t keep up with the growing data, causing frequent outages and costly downtime—up to $300,000 per hour. These challenges caused major stress on DAR’s current infrastructure, employees, and customers, making it clear that they needed an upgrade.

To solve these challenges, DAR upgraded to a more powerful database engine that could handle larger data volumes and adapt as it grew without overhauling its entire infrastructure. DAR teamed up with Data-Sleek to set up a strong data warehouse solution. This upgrade sped up data processing and made it more accurate, reducing the amount of data locked or filtered out.

DAR also ensured smooth integration to the new system, avoiding service interruptions that could damage its reputation. With the new system, data quality and accuracy were doubled, processing sped up from 40 million rows of data daily to handling 15 billion rows in less than an hour, and storage and management costs were reduced by 50%.

As a result, DAR’s performance improved dramatically, helping them solidify their position as a top provider of accurate digital asset data. The company grew its client base by 600% and grabbed the largest market share, all while keeping the trust and confidence of its clients in an increasingly unpredictable market.

Other Common Challenges in Data Management

While DAR dealt with its data management challenges, there are still plenty of other common challenges in the industry. These challenges can create significant roadblocks for organizations trying to manage their data effectively and securely. Let’s go over some of the most frequent data management obstacles that companies often deal with.

Data Silos

Data silos are one of the biggest headaches in data management. When different departments store data in separate systems without sharing it, it creates isolated pockets of information. This makes it hard to access and share across the organization, leading to inefficiencies, duplicate efforts, lack of a unified view of the data, and missed opportunities.

Data Security

Data security is a critical issue, with the risk of data breaches and cyber threats growing alongside the volume of data being managed. The dispersed nature of data—often stored in different silos—makes it even harder to secure, increasing the risk of unauthorized access and data leaks.

Insufficient Data Governance

Lack of data governance data governance is a common issue. Data management becomes chaotic without clear policies and standards, leading to poor data quality and compliance issues. Many organizations fail to establish proper data governance frameworks, resulting in inconsistent data practices across departments.

Complexity of Financial Data

Handling financial data is incredibly complex due to the sheer volume and variety of data types. This data is often fragmented across multiple platforms, making it tough to consolidate and analyze. This fragmentation makes it hard to get a clear, unified view of the data, which is essential for compliance, risk management, and accurate reporting.

Skillset Gap

There’s a noticeable gap in the skills required for modern data management, especially with the rise of new technologies. Many companies rely on outdated systems and practices, and also struggle to find or train professionals who are proficient in both legacy systems and the latest data management tools. This gap can slow down projects, increase costs, and lead to suboptimal use of data resources.

Effective Solutions for Tackling Different Data Management Challenges

Now that we’ve covered the challenges in data management let’s shift our focus to the solutions that can help tackle these issues head-on. Here are some of the most effective data management services that can help your organization overcome challenges and turn them into opportunities for growth and efficiency.

Data Warehousing

Data warehousing services address the challenge of fragmented financial data by consolidating data from multiple sources into a single repository. It’s particularly effective in reducing data silos, which can otherwise hinder decision-making and lead to inconsistencies. Companies report that data warehousing really speeds up how fast they can process and analyze data. In fact, 53% of IT managers ranked this as their top budget priority, and 53% of IT managers and executives chose hybrid or multi-cloud data warehouses to make data more flexible and easier to access.

Robust Data Governance

Having robust data governance helps keep the data accurate, secure and in line with regulations. Companies with strong data frameworks experience improved data quality and consistency, which directly support better decision-making and operational efficiency. The data governance market is expected to grow to a projected value of over $15 billion by 2032 with a compound annual rate (CAGR) at 18.20%. This growth shows the increasing need for data quality and security, especially in regions where stringent data protection laws are in place.

Advanced Analytics and BI Tools

Advanced analytics and BI services and tools are proving to be highly effective in large volumes of financial data. These tools help identify patterns, predict trends, and provide actionable insights that drive business outcomes, particularly in decision-making, operational efficiency, and customer insights. These tools are particularly valued for their scalability, ease of integration, and ability to handle large datasets. Statistics show that the global business intelligence market is growing rapidly, with the cloud BI market expected to reach $17.2 billion by 2030. Additionally, the embedded analytics market, which integrates BI tools directly into business applications, is projected to hit $52.2 billion by 2026, with a CAGR of 9.9%.

Cloud-Based Solutions

Cloud-based solutions are proving to be highly effective for organizations across the finance industry. As of 2024, nearly 98% of financial institutions are using some form of cloud computing, a sharp increase from 91% in 2020. Moreover, 94% of businesses report improved security after moving to the cloud. This widespread use is driven by the need for flexibility, data accessibility, and real-time data sharing across departments and locations.

Data Security Measures

Data security is a top priority in the finance industry due to the high risk of cyber-attacks and data breaches. Most financial institutions are increasing their investment in data security with an average budget increase of 6%. Investment in hardware, software, and services related to cybersecurity is expected to reach nearly $300 billion in 2026. This trend shows the growing importance of protecting sensitive financial data amid rising cyber threats, the demands of providing a secure hybrid work environment, and the need to meet data privacy and governance requirements.

Employee Training

Regular training sessions on data privacy, phishing awareness, and secure data handling can help employees recognize potential threats and act appropriately. Osterman Research found that phishing awareness training increases employees’ ability to recognize cyber-attacks from 23% to 68%, with even greater improvement when combined with phishing simulations. Furthermore, companies that invest in training programs see a 24% higher profit margin and 218% higher income per employee compared to those that do not invest in training.

Data Privacy and Anonymization Techniques

Data privacy and anonymization techniques help protect sensitive information while maintaining data utility. Methods such as data masking, pseudonymization, and generalization are effective in reducing the risk of re-identification, making it difficult for personal data to be easily traced back to individuals. The Cisco 2024 Data Privacy Benchmark Study found that 95% of organizations believe investing in data privacy brings more benefits than costs, with an average return of 1.6x, and 30% of organizations report a 2x ROI.

Transform Your Financial Data With Data Sleek’s Expert Solutions!

Maximize the value of your financial data, whether it’s in the cloud or on-premises, with Data Sleek. Our solutions help you easily pull data from different sources and analyze it in real time, giving you the power to personalize customer experiences, lower risks and boost efficiency.

From fraud to automated back-office processes, we’ve got the tools and experts to help your business run smoother and smarter. Schedule a free consultation today, and let’s make it happen!

FAQs About Financial Data Management Services

What Are the Various Data Types in Financial Management?

Financial management typically deals with structured data like transactions and financial statements, unstructured data like emails and contracts, and real-time data such as stock prices and market trends.

How Many Types of Stages Are There in Data Management?

Data management generally includes several stages: data acquisition, storage, processing, analysis, governance, and disposal. Each stage is critical to keep the data accurate, safe, and useful so companies can make smart decisions.

How Big Data Is Bringing Change in the Financial Industry?

Big Data is changing the game in finance by making it easier to manage risks, understand customers better, and predict trends. This change helps banks and other financial companies make smarter choices and offer more personalized services.