In the dynamic landscape of SaaS, success isn’t just about delivering standout solutions—it’s about continuously harnessing and interpreting data. This data is the lifeblood of subscription-based SaaS enterprises that can propel them to new heights or signal impending challenges. Yet, gleaning actionable insights from this vast sea of information is no small feat.

This brings us to the importance of KPIs, or Key Performance Indicators, which serve as critical signposts illuminating the path forward.

While the term “KPI” might sound technical, its essence is straightforward: these are the vital metrics that capture the health and trajectory of a business.

Typically managed by IT or Business Analytics teams, these crucial data points are distilled into comprehensive reports, shedding light on the company’s performance for key stakeholders, from C-suite executives to board directors.

At its core, a SaaS business thrives on the recurring revenue generated from its monthly, quarterly, or annual subscription offerings. It’s worth noting that while these businesses might have additional one-time fees or offer occasional upsells, such transactions usually stand apart from the regular monthly KPI evaluations.

What is a Saas business?

Software as a Service, commonly known as SaaS, refers to a cloud-based service where instead of downloading software on your desktop PC or business network to run and update, you access an application via an internet browser.

This business model allows users to access software applications over the Internet on a subscription basis, often eliminating the need for internal hardware or software installation. SaaS businesses typically offer solutions that are scalable, accessible from any device connected to the internet, and come with automatic updates and patches.

Examples include CRM systems, messaging applications, and office suites. The SaaS model has become increasingly prevalent due to its cost-effectiveness, flexibility, and ease of integration with other services.

What Are KPIs?

In modern technology vernacular, “KPI” or “KPIs” stands for Key Performance Indicators.

These are statistics that a business can measure to estimate the stability of its business.

Regarding the SaaS (Software as a Service) model, these KPIs become more critical due to their subscription business model.

Regardless of your services, the trick is identifying the smaller metrics that help determine your business’s health.

Why Are KPIs Important for SaaS Businesses?

Subscription KPIs are vital for tracking the success of your business.

Considerable time and effort must be taken to track and record the following KPIs to maximize revenue and avoid costly business decisions.

Poor performance in one or more KPIs will give you the necessary data to identify and prevent negative trends in your business.

Tracking SaaS KPIs also allows you to plan future revenue so you can grow more comfortably.

Most SaaS businesses face difficulty accurately reporting KPIs and integrating various data sources into one centralized location.

This is where Data Solutions Agencies like Data Sleek come into play.

Using the skill sets and experience of 3rd party agencies, SaaS companies can avoid personnel costs while effectively leveraging their in-house staff.

Most SaaS startups do not have full-time database administrators or data analysts, making it challenging to leverage accurate and real-time KPIs.

By relying on 3rd party agencies, they can still transform their data pipelines into meaningful business insights.

Any SaaS business’s health comes down to acquiring and retaining existing customers and active subscribers.

Businesses that fail to maintain accurate and timely records of their customers can fall into the trap of overpaying for customer acquisition.

Customer growth is paramount for both investors and key executives.

Below we will outline the Top 10 SaaS KPIs that every subscription-based SaaS business should be tracking.

Top 10 SaaS KPIs for Growth

All subscription-based SaaS businesses should track the following KPIs.

Failing to do so could mean costly expenses or loss in revenue or customer base.

Accurately tracking and analyzing the following KPIs should be integral to your IT and business analytics team’s day-to-day duties.

Active Subscriber Count (ASC)

Active Subscriber Count is one of the most obvious metrics to track for SaaS.

In short, it is the number of paying customers for your service at any given time.

Most SaaS businesses sell their services on a monthly or annual subscription model.

Most SaaS businesses allow customers to sign up for their service at will and can cancel at any time or once their contract has expired.

Because the active subscriber count is continuously changing, key decision-makers must have easy access to the most up-to-date data.

Active Subscriber Count can also be broken down into a few sub-categories like:

Which subscribers are the most profitable?

Which are the most engaged with the product (who uses your product the most)?

Which customers are most likely to stay customers

Which customers are most likely to churn (also known as canceling their subscription to your service)?

ASC is one of the best KPIs for executive committees and board meetings because it tells the “story” of business growth.

Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC), an essential key performance indicator, is the total sum of marketing and sales efforts to acquire a single customer.

CAC is another critical KPI to track because a high cost to get a customer can be harmful to overall business health.

When combined with other KPIs like Active Subscriber Count (ASC) or MRRC (Monthly Recurring Revenue Churn), you begin to paint an excellent outlook for your business.

A standard formula used to calculate CAC is:

CAC = Total Sales and Marketing Costs / Number of Customers Acquired

When a SaaS business begins, its CAC can be exceptionally high as it gains its first few hundred customers.

It is common for customer acquisition cost to be 150-200% or more in their first year of business.

If done correctly, businesses with high CACs can compensate for the initial loss of revenue by upselling their current customers to more expensive services or multi-year commitments.

Once a subscription-based SaaS company establishes its credibility in the marketplace, it can see a CAC of about 20-30%.

CAC can also provide insights into the effectiveness of your marketing and sales efforts.

Many SaaS businesses struggle to centralize all marketing channels and accurately attribute each new costume acquisition.

Finally, tracking customer acquisition cost accurately can provide future insights into the ability to scale and remain profitable.

Customer Lifetime Value (CLV)

Customer Lifetime Value is the revenue received by each customer over the lifetime of their subscription.

It also predicts the revenue a business will receive over a defined period.

Like ASC, you can add segments of CLV for further insights into your profitability.

Other factors like frequency, recency, and monetary value should not be ignored.

Simply put, CLV is the most critical KPI for driving actionable insights.

Increasing CLV should be the focus of your marketing and sales strategy.

CLV can also tell you where to invest more resources to acquire the best customers and avoid the least profitable sales channels.

Monthly Recurring Revenue (MRR)

Monthly Recurring Revenue, or MRR, is a vital metric for subscription-based businesses or businesses with consistent monthly revenue streams. It represents the total predictable and recurring revenue a company can expect monthly, excluding one-time fees or variable charges. MRR provides businesses with a clear view of revenue trends over time and is pivotal for forecasting, budgeting, and assessing the overall financial health of a company.

MRR is the backbone of all SaaS KPIs and provides insights into plan upgrades, downgrades, pricing strategies, and discounts.

Other subcategories of MRR include:

New MRR – converted paid customers in a given timeframe.

Expansion MRR – the increase in MRR from existing customers over time.

Contraction MRR – the decrease in MRR from existing customers over time.

Net New MRR – the delta of current MRR to Expansion MRR over a given time.

Monthly Recurring Revenue and its sub-categories are essential for each business to understand and utilize.

A business can quickly lose money and customers without strict adherence to these KPIs.

Annual Recurring Revenue

Annual Recurring Revenue, often abbreviated as ARR, is a critical metric for subscription-based businesses or businesses with consistent annual revenue streams. It quantifies the total predictable and recurring revenue a company can anticipate annually, excluding one-time fees, variable charges, or non-recurring revenue sources. Like its monthly counterpart, MRR, ARR offers an insightful snapshot of a company’s projected revenue over a year, making it integral for long-term planning, forecasting, and evaluating its overall financial stability.

Net New Annual Recurring Revenue

Where:

New ARR: Revenue from new customers.

Expansion ARR: Additional revenue from existing customers (e.g., upsells, cross-sells).

Churned ARR: Revenue lost from customers who downgraded or canceled.

Annual Recurring Revenue Growth Rate:

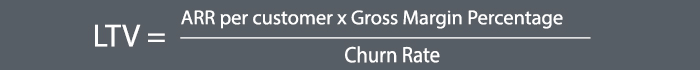

Customer Lifetime Value (LTV) when considering Annual Recurring Revenue:

Often, the monthly recurring revenue (MRR) is used for LTV calculations, but if focusing on an annual basis:

Margin Percentage: The Gross Margin Percentage accounts for costs directly associated with delivering the service, and Churn Rate is the annual percentage rate customers cancel their subscriptions.

Monthly Recurring Revenue Churn (MRRC)

Monthly Recurring Revenue Churn, often denoted as MRR Churn is a pivotal metric for subscription-based businesses that measures the loss of monthly recurring revenue over a given period, typically a month. This can be due to customer cancellations, downgrades, or non-renewals.

Expressed as a percentage, MRR Churn helps businesses understand the rate at which they are losing subscription revenue, which can be crucial for assessing customer satisfaction, product fit, and overall business health. A high MRR Churn rate might indicate underlying issues that need addressing, while a low rate suggests strong customer retention and product value.

Customers who leave your company and no longer pay for services are considered “churn.”

MRRC is measured by the number of customers who cancel or do not renew their monthly subscriptions.

Average Revenue Per User (ARPU)

ARPU (Average Revenue Per User) is a critical SaaS KPI to track. Average Revenue Per User is a metric businesses use to gauge the revenue generated per user or customer, typically over a specific period, such as a month or year.

It is calculated by dividing the total revenue by the number of users or customers during that period. ARPU provides insights into the value derived from each customer and can be instrumental in making pricing, marketing strategies, and product development decisions. A rising ARPU indicates an increasing monetization per user, whereas a declining ARPU might signal potential challenges in revenue generation or customer satisfaction.

Tracking your ARPU KPIs allows you to see how much value your customer base is providing your business.

To calculate your ARPU, divide the MRR from your active customers by your total number of customers.

Tracking ARPU lets you make educated plans for current and long-term business decisions.

ARPU also gives you insights into which customer personas or “avatars” are most profitable.

Customer Churn

Just as ASC measured the number of customers at any given time, the Customer Churn relates to how many customers your subscription business loses at any given time.

Customer Churn can be beneficial in calculating particular marketing campaigns to measure how effective they were.

Months to Recover CAC

Months to Recover CAC or MRCAC helps determine the timeframe to recover the CAC after you’ve closed a customer.

This KPI can help determine the effectiveness of marketing and sales campaigns and shed light on your customer onboarding processes and procedures.

The faster you can recover your CAC, the better off your long-term profitability will be.

Customer Engagement Score

The Customer Engagement Score is a SaaS KPI measuring customer engagement with your service.

Customer Engagement includes the following factors:

How often do they log into your service?

What are they using your software for?

How much bandwidth do they use on your platform?

How many users they’ve set up with your service?

Customer Engagement is a crucial measurement precursor to MRRC or customer churn.

If your customer is not interacting with your service or platform, they are less likely to renew at the end of their current subscription.

Implementing ways to increase engagement, such as product training, assigning a Customer Success Manager, and periodic check-ins with your customers, will minimize churn.

SaaS Bookings

This KPI metric is the total revenue customers have pledged to your business in a given time.

It pulls together all your sales and marketing channels to provide the most transparent way to calculate revenue growth.

It is not necessary to include the following in your SaaS Bookings calculations:

Discounts

Setup Fees

One-time fees

Credit adjustments

We also encourage you to measure your proportion of new bookings (new customers) to upgrade bookings (Expansion MRR).

This measurement will allow you to allocate more sales attention to upselling existing and potential customers.

The Cornerstone of SaaS: Revenue Metrics

In the ever-evolving realm of the SaaS industry, understanding the financial heartbeat of a business is paramount. It’s not just about knowing how much revenue is coming in but also dissecting where it comes from, predicting its future trajectory, and acknowledging the pitfalls that might lead to revenue loss.

Assessing Revenue Generated: One might argue that the lifeline of any SaaS enterprise lies in its ability to generate revenue consistently. But it’s not just about the total figure; it’s about comprehending the nuances. Many SaaS businesses have multiple tiers, varied contract lengths, and diverse pricing models. All of these play a role in determining how much revenue a company can anticipate, not just today but in the subsequent months and years.

Predicting Future Revenue: The subscription-based nature of the SaaS business model offers a distinct advantage: the ability to predict future revenue. With signed contracts, especially those that span several months or even years, SaaS businesses can forecast their financial outlook with certainty. This predictability is one of the model’s main draws, allowing for more informed budgeting, spending, and investment decisions.

Navigating Revenue Lost: No business is immune to losses, and the SaaS industry is no exception. Churn, or the rate customers cancel their subscriptions, directly translates to revenue lost. Monitoring and understanding churn is vital because of its immediate financial implications and as a product or service satisfaction indicator.

Company’s Financial Health: The synthesis of these metrics – revenue generated, forecasted revenue, and revenue lost – provides a holistic view of a company’s financial health. While many SaaS companies might boast impressive sign-up rates or initial sales, a deeper dive into these numbers can reveal the actual sustainability and health of the business.

Economic Viability: Beyond the immediate, these revenue metrics are crucial in assessing a company’s economic viability. Investors, stakeholders, and potential partners often rely on these numbers to gauge a SaaS venture’s long-term potential and profitability.

In conclusion, a keen understanding of their revenue metrics is non-negotiable for SaaS businesses to thrive and navigate the competitive landscape truly. They don’t just paint a picture of the present; they offer invaluable insights into the future.

How Sales and Marketing Teams Rely on SaaS KPIs

The symbiotic relationship between marketing and sales teams is pivotal for the growth of a SaaS business. But how do they harness the power of KPIs to drive this growth?

Guiding the Marketing Strategy: KPIs are a compass for marketing efforts, helping identify which channels or campaigns generate the most qualified leads. This allows for optimizing the marketing strategy, ensuring that resources are directed towards efforts yielding the best results.

Aligning Sales and Marketing Efforts: Consistent monitoring of KPIs can highlight gaps or overlaps between sales and marketing efforts. For instance, if there’s an influx of marketing-qualified leads but a low conversion to paying customers, it may indicate a need for better alignment between the two teams or a deeper dive into the quality of the leads.

Enhancing Lead Quality: Not all leads are created equal. By tracking the conversion rate of marketing qualified leads to actual paying customers, the marketing team can refine its targeting methods, ensuring the sales team is equipped with high-potential leads.

Quantifying Marketing ROI: KPIs enable the tangible measurement of returns on marketing efforts. By correlating marketing campaigns with spikes (or drops) in qualified leads or paying customers, teams can more effectively gauge the success of their strategies and adjust accordingly.

Empowering the Sales Team: With clear KPIs, the sales team can prioritize their pipeline, focusing on leads more likely to convert. Moreover, understanding the sources and campaigns that generate these leads can give sales representatives valuable context during their pitches.

KPIs aren’t just numbers for a SaaS business aiming to bolster its growth trajectory. They are the connective tissue that ensures sales and marketing teams operate in tandem and synergistically amplify each other’s impact.

SaaS KPIs For Growth Conclusion

As you can see, there are many KPIs and sub-KPIs that every SaaS business should track and measure.

There is an old saying:

“What gets measured gets improved.”

If you are not tracking any or all of these SaaS KPIs in your SaaS business, it may be time for drastic changes in your data approach.

At Data Sleek, we help SaaS businesses streamline data into meaningful analytical insights, providing important saas kpis for subscription business growth. We can work with your marketing team to establish a list of key performance indicators or your customer success team to develop a list of customer success KPIs.

We work with cutting-edge data technologies like Fivetran, Snowflake Computing, and DBT, which are key to building an efficient and scalable KPI reporting solution.

Combining these powerful tools helps eliminate roadblocks and blindspots in your business.

Data Sleek can help integrate your data pipelines and analytics in a short amount of time and with limited resources.

We provide your company with human resource “elasticity.”

This means you can quickly build a dedicated team with the right expertise to fine-tune your KPI dashboards.

We will also mentor your business analytics team simultaneously so that nothing is lost in translation.

Once the project is complete, you can quickly scale down personnel.

We want to help you reduce your overall cost and increase the speed of delivery.

If you want to discuss how we can streamline your SaaS KPIs into meaningful insights, please fill out the brief questionnaire on your page.

We look forward to working with you and helping you master your SaaS KPIs for continued growth!