Imagine a finance team navigating through a maze of spreadsheets and manual reports.

That’s now outdated. With enterprise digital transformation leading the way, finance offices efficiently integrate real-time data, advanced analytics, and automation.

Today, let’s examine how this shift redefines finance, making it more agile, transparent, and strategic. This blog will also discuss the strategies, challenges, and trends you need to know to navigate this technology’s evolving landscape.

What Is Enterprise Digital Transformation?

Enterprise digital transformation reshapes businesses using technologies to change models, improve processes, and find new business value. It impacts customer interactions, internal operations, employee training, and data management. Rethinking operations, automating processes, and developing new products and services are key to boosting efficiency, enhancing customer experiences, and driving innovation.

Enterprise Digital Transformation in Finance

The financial services sector is more competitive than ever, with customers demanding seamless, personalized digital experiences. Financial institutions must focus on digital transformation initiatives to stay relevant and meet evolving customer needs.

It also aims to boost revenue, enter new markets, offer personalized experiences, improve process changes, manage risk, and reduce costs, creating a more agile, responsive, and customer-centric industry.

Why Digital Transformation Is Important in the Financial Sector?

The financial services sector is more competitive than ever, and customers demand seamless, personalized experiences. To stay relevant and meet evolving customer needs, financial institutions must focus on digital transformation initiatives.

It offers opportunities like AI and ML to create new tools and products, improve risk management, and enhance fraud detection. It also enables personalized financial advice, helping institutions meet customer expectations. A successful digital transformation maintains competitiveness, boosts revenue growth, and secures a competitive advantage in the digital landscape.

What Are the Key Drivers of Digital Transformation in Finance?

Financial services are driven toward this technology by growing customer expectations for ease, personalization, and accessibility. Regulatory pressures and compliance demands also push the adoption of new technologies. The factors reshaping the industry include:

- Regulatory Changes and Compliance Demands: Regulators update rules to protect consumers and maintain market stability as the digital economy evolves. Financial institutions must invest in technology to meet these regulations, automate compliance tasks, and improve data accuracy.

- Customer Expectations: Customers demand personalized experiences, easy interactions, and quick access to financial services. Financial institutions must focus on digital solutions like mobile banking apps, personalized advice, and real-time alerts to enhance satisfaction.

- Technological Advancements: Advances in AI, ML, blockchain, and the Internet of Things (IoT) are transforming finance. AI and ML improve fraud detection and customer service, while blockchain enables secure transactions. IoT provides real-time data for better financial decisions.

4 Core Technologies Powering Digital Transformation in Finance

As we delve into the core digital tools, let’s start with the transformative impact of Artificial Intelligence and Machine Learning.

1. Artificial Intelligence and Machine Learning

AI and ML revolutionize finance by enabling data analysis and decision-making. ML algorithms help assess credit risk, detect fraud, and offer personalized investment advice. AI chatbots and virtual assistants enhance customer service by providing quick responses and effective resolution.

2. Blockchain Technology

Blockchain offers enhanced data privacy, transaction security, and opportunities for decentralized finance (DeFi). It ensures transparency and security, making it ideal for cross-border payments, supply chain financing, and identity management. DeFi allows direct lending, borrowing, and trading without intermediaries.

3. Cloud Computing

Cloud computing offers scalability, lower costs, and improved flexibility. It enables financial institutions to scale operations, collaborate, and innovate quickly. Cloud services also support the development and launching of new financial products and services.

4. Data Analytics and Big Data

Big data analytics helps financial institutions derive valuable insights from vast data sets. It enables the creation of customized products, targeted marketing, and improved risk management. Data analytics optimizes operations, enhances customer experiences, and provides a competitive edge.

6 Digital Transformation Strategies for Financial Institutions

Financial institutions must develop comprehensive strategies to navigate this successfully. These strategies should:

1. Develop a Digital-First Culture

Digital transformation is about cultivating a digital-first mindset across the organization. Employees should be open to change, embrace new technologies, and contribute to digital business innovation. Companies must invest in training programs to equip employees with skills, fostering a collaborative and innovative workplace. A focus on culture enhances employee engagement and productivity.

2. Foster Innovation Through FinTech Collaborations

Collaborating with FinTech startups is crucial for traditional banks to drive innovation. These partnerships can take various forms, such as strategic alliances, joint ventures, or acquisitions. By leveraging FinTech solutions, traditional banks can quickly adopt new technologies, explore new business models, and reach new markets, ultimately enhancing their product offerings.

3. Prioritize Cybersecurity in a Digital Age

As digital transformation progresses, prioritizing cybersecurity is essential. Financial institutions must implement advanced security measures, conduct regular vulnerability assessments, and train employees on cybersecurity best practices. Protecting customer data and financial assets through encryption, access controls, and multi-factor authentication is critical to maintaining trust and compliance.

4. Implement Agile Methodologies for Rapid Deployment

Agile methodologies revolutionize software development and are vital for enterprise digital transformation. Financial institutions can deploy software faster, reduce time to market for new products, and enhance customer and employee experience through real-time feedback by focusing on iterative development, continuous improvement, and flexibility.

5. Leverage Enterprise Analytics for Informed Decision-Making

Enterprise analytics allows financial institutions to make informed decisions based on real-time insights. By analyzing customer behavior, market trends, and risk factors, institutions can develop personalized products, improve marketing strategies, and enhance risk management.

6. Enhance Customer Experience Through Digital Channels

Improving customer experience is a key strategy in digital transformation. Financial institutions should invest in user-friendly digital channels like mobile apps and online platforms to provide seamless and personalized services. Enhancing customer interactions boosts satisfaction and loyalty, driving long-term growth.

7 Challenges and Solutions in Digital Transformation In Finance

While the benefits of enterprise digital transformation are clear, financial institutions face challenges, including:

1. Overcoming Resistance to Change Within Organizations

Resistance to change is a significant hurdle. To manage this, it’s crucial to communicate the benefits of transformation, involve employees in decision-making, and provide proper training and support. Leaders must share their vision and commitment, creating a supportive environment that encourages employee buy-in and ownership.

2. Navigating Regulatory Challenges in a Digital World

Rapid technological changes bring regulatory challenges. Financial institutions must adopt flexible compliance strategies, stay updated on regulations, and engage with regulators. Building a culture of compliance through regular training and transparent practices helps mitigate regulatory risks while embracing digital innovation.

3. Ensuring Data Privacy and Security for Customers

Data privacy and security are paramount. Financial institutions should implement strong security measures like encryption, access controls, and multi-factor authentication. Adhering to privacy regulations and maintaining high ethical standards in data handling builds customer trust and ensures compliance.

4. Measuring the Success of Digital Transformation Efforts

Measuring success is essential. Financial institutions should establish KPIs aligned with business goals, tracking customer satisfaction, operational efficiency, revenue growth, and cost reduction metrics. Regularly reviewing these metrics allows for strategic adjustments and continuous improvement.

5. Key Performance Indicators for Enterprise Digital Transformation

Tracking KPIs is crucial for assessing the impact of digital transformation. Key metrics include:

| KPI Category | Specific KPIs | Description |

| Operational | Transaction processing time, Automation rate, System uptime | Measures the efficiency and effectiveness of operations |

| Financial | Cost-to-income ratio, Revenue growth, Customer acquisition cost | Tracks financial impact on profitability and growth |

| Customer-centric | Customer satisfaction score, Net Promoter Score, Customer churn rate | Measures customer experience and loyalty |

6. Customer Satisfaction and Engagement Metrics

Focusing on customer satisfaction and engagement is vital. Financial institutions should gather detailed feedback through surveys, social media, and feedback platforms. Monitoring channel usage provides insights into the effectiveness of solutions, enabling continuous improvement.

7. Financial Health and Growth Indicators Post-Transformation

Monitoring financial health and growth post-transformation is crucial. Key indicators include revenue growth, market share, and profitability metrics like ROE and ROA. These metrics help assess the returns on investments and the value created for stakeholders.

What Are the Emerging Digital Transformation Trends in Finance?

The financial services sector will continue evolving with trends such as:

The Rise of Neobanks and Challenger Banks

Neobanks and challenger banks are transforming the banking landscape with their digital-first approach, targeting tech-savvy customers seeking flexible, user-friendly services. According to Verified Market Research, the neo and challenger bank market was valued at $118.01 billion in 2023 and is projected to reach $2597.03 billion by 2031, growing at a CAGR of +47.17%.

Operating primarily through mobile apps and websites, they offer services focused on user experience, real-time information, and personalized features. Traditional banks must adapt to these customer-centric models to remain competitive.

Predictive Analytics and Personalized Financial Services

Predictive analytics and customer profiling enable financial institutions to offer tailored products and services. By leveraging ML and big data, institutions can analyze customer behavior, risk tolerance, and investment goals to provide personalized advice and recommendations. This enhances customer engagement and loyalty through a more customized experience.

Regulatory Technology (RegTech) Evolution

RegTech uses AI and ML to help businesses comply with regulations. Allied Market Research reports that the global RegTech market was valued at $9 billion in 2022 and is expected to reach $66.9 billion by 2032, with a CAGR of +22.6% from 2023 to 2032.

These solutions streamline compliance processes, reduce risks, and improve operational efficiency. As RegTech evolves, it offers a competitive edge by ensuring data privacy and meeting compliance requirements.

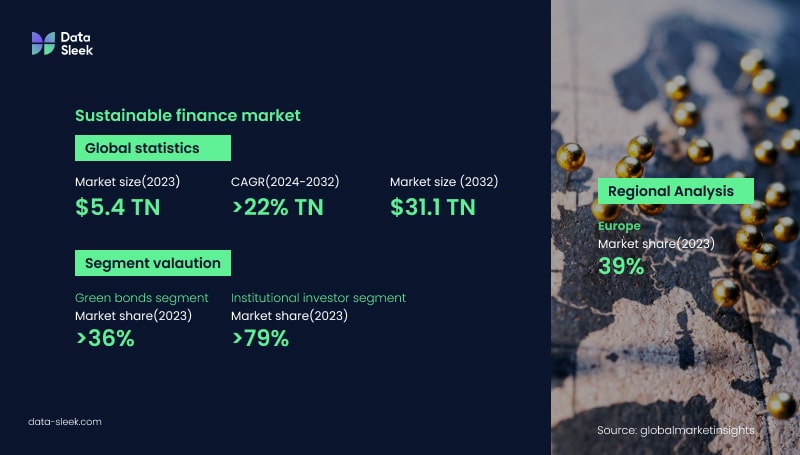

The Growing Importance of Sustainable Finance

Sustainable finance, including ESG and green finance, is rapidly gaining traction. According to Global Market Insights, the sustainable finance market was valued at $5.4 trillion in 2023 and is expected to grow at a CAGR of over +22% from 2024 to 2032, driven by increased awareness of environmental and social concerns among governments and the public.

Financial institutions increasingly integrate ESG criteria into investment reviews, risk assessments, and lending practices. As awareness of environmental and social issues grows, sustainable finance is essential, aligning investments with ethical values and fostering a better future.

Blockchain and Decentralized Finance (DeFi)

Blockchain technology and DeFi revolutionize financial services by enabling secure, transparent, decentralized transactions. According to Grand View Research, the global decentralized finance market was valued at $13.61 billion in 2022 and is projected to grow at a CAGR of +46.0% from 2023 to 2030.

These innovations reduce reliance on traditional intermediaries, offering faster and more cost-effective solutions. As blockchain and DeFi mature, they will reshape the financial landscape, providing new opportunities for growth and efficiency.

Enhanced Customer Experience Through Digital Transformation

Improving customer experience through digital channels is a key trend. Financial institutions invest in user-friendly mobile apps and online platforms to offer seamless, personalized services. Enhancing interactions boosts customer satisfaction and loyalty, driving long-term growth and competitiveness.

Boost Financial Success With Enterprise Digital Transformation

Unlock your financial institution’s potential with a successful enterprise digital transformation. Data Sleek is here to help you navigate the future of finance through flexible strategies, FinTech collaborations, and sustainable practices.

Ready to revolutionize your operations? Contact us today, and let’s shape the future of finance together!

Finance Digital Transformation FAQs

Curious about how this technology can impact your financial institution? Here are some common questions and answers to help you understand its significance and potential business outcomes.

What is the significance of digital transformation in finance?

Digital transformation in finance helps improve innovation, efficiency, and customer experience. This change allows institutions to adjust to new market needs, stand out with better products, and stay ahead in today’s fast-moving world.

How do AI and machine learning contribute to financial services?

AI and machine learning help make decisions faster, automate tasks, and better assess risks in financial services. They analyze large amounts of data to find patterns, predict trends, and create insights, which drive efficiency and spark new ideas.

Can this technology improve customer satisfaction?

Digital transformation improves customer satisfaction, allows companies to provide personalized services, and helps them respond faster. This leads to smooth engagement for customers at every step of their journey.

What are the challenges faced during enterprise digital transformation?

Financial institutions have some tough challenges. They need to connect with legacy systems, handle fear of change within the company, fix gaps in skills, and protect against constant cyber threats.