Businesses today generate massive amounts of data as a byproduct of their daily operations. However, simply having data isn’t a competitive advantage — knowing how to monetize the mountain of data a business is sitting on is.

In this guide, we’ll go over how data monetization directly impacts your bottom line and how it has become a defining factor for long-term profitability and resilience of your business. But most importantly, we’ll also talk about what it takes to lead the charge.

What is Data Monetization (Beyond the Buzzword)?

Though it’s often tossed around as a buzzword and somewhat of a vague promise of turning data into dollars, data monetization is actually a process of generating financial returns from data assets, as defined by Barb Wixom in her book Data is Everyone’s Business

At its core, data monetization is about extracting tangible, measurable business value from the organization’s data. It’s about leveraging one of the most underutilized assets modern companies have at their disposal to sharpen decision-making, streamline operations, offer personalized customer experiences, and realize value.

Defining Data Monetization for the C-Suite

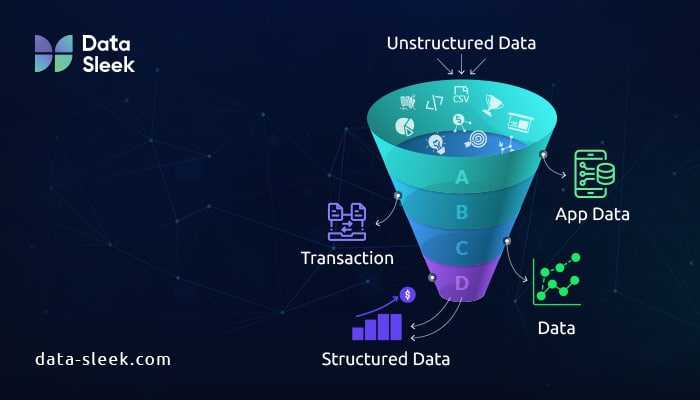

Creating data is usually a byproduct of typical sales operations, such as sales transactions, marketing operations, order fulfillment, logistics, and shipping. Taking that raw data and turning it into real-world economic value is the main point of data monetization practices.

That value derived from those practices may come in the form of new income channels or from savings realized through reduced expenses and lower risks. In either case, the generated and adequately processed data becomes more than a byproduct of doing business. Instead, it becomes a business driver itself.

With that in mind, it’s easy to see that data monetization isn’t solely a technical concern or an IT initiative, but a business strategy with direct financial impact. As such, it should be supported and championed by the organization’s leadership.

It’s important to note that there are two main types of data monetization:

- Direct Data Monetization—Direct data monetization refers to transforming your business data into a revenue-generating asset. This could mean launching a Data-as-a-Service (DaaS) offering, licensing proprietary insight to partners, or packaging data into products sold to consumers, suppliers, or third parties. A financial institution selling anonymized transaction trend reports to market researchers or hedge funds is a good example of data monetization.

- Indirect Data Monetization—Indirect data monetization refers to the internal use of data to enhance the performance and profitability of a business. This includes optimizing supply chains, reducing churn through predictive modeling, or tailoring product recommendations to increase conversion rates. Though these initiatives don’t generate revenue directly, they significantly boost the bottom line through enhanced efficiency.

Why Your Enterprise Data is an Untapped Goldmine

Most enterprises generate a lot of data every day, but only a fraction of that data is used to generate any value. Retailers, for example, sit on mountains of transactional and foot traffic data. Banks log millions of financial interactions, and healthcare providers collect troves of clinical, operational, and patient data. And each of these datasets has an untapped potential to generate value.

In sectors like retail, data can reveal which promotions help move the needle and which drain resources. In banking, analytics on credit use patterns can be used to create new financial products or improve fraud detection, while healthcare can use its own data to improve care outcomes.

The opportunities for data monetization aren’t limited to a single industry either; they lie in the respective industry’s approach to data transformation into operational and commercial advantages. To put this into numbers, McKinsey Global Institute estimates that data-driven organizations are 23 times more likely to acquire customers and 19 times more likely to be profitable.

The Tangible Impact: How Data Monetization Fuels Your Bottom Line

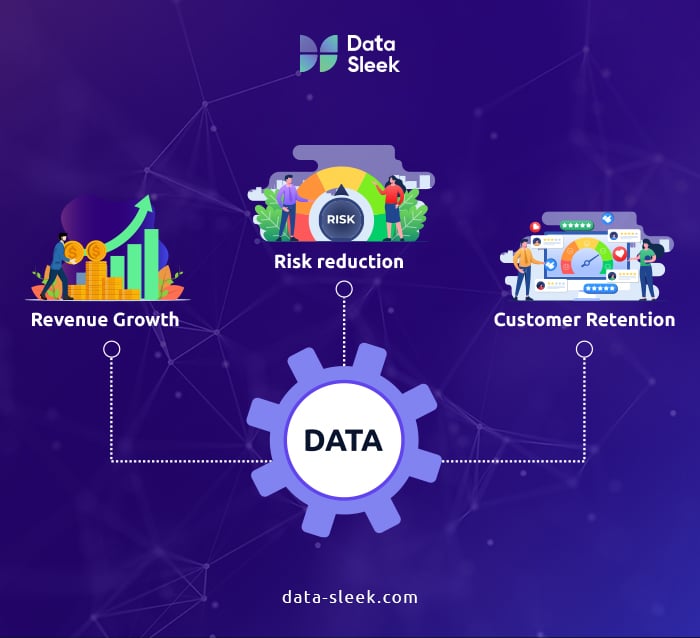

The main point of every initiative is the impact it makes, not theoretical potential, but actual, measurable financial results. When executed strategically, data monetization does more than just enhance operations. It also drives growth, optimizes margins, and enhances enterprise value by creating new revenue streams, lowering operational costs, and strengthening competitive positioning.

So, the real question here isn’t “how” or “if” data pays; when adequately executed, the real question is “how soon” does your data monetization strategy pay off?

Boosting Revenue Through Data-Driven Products & Services

Increasing the profitability of your business through data monetization doesn’t require reinventing your business plan. However, it does require that you enhance your business plan with data-infused offerings.

Retail is a really good example here. A global retailer that uses real-time customer data to hyper-personalize offers across digital and physical channels can tailor promotions based on the customer’s purchase history and behavior. This often leads to measurable improvements in key performance indicators, such as larger cart sizes and more frequent repeat purchases.

Another example comes from the financial sector, where a financial institution uses behavioral analytics to detect fraud with great speed and accuracy. This helps them transform their anti-fraud model into a proprietary tool, which can be licensed to smaller banks and fintech startups.

The introduction of AI and machine learning models further multiplies the potential for data monetization, especially when models are trained on proprietary datasets. This allows them to produce insights that are unique to the business and can’t be replicated by the competition.

Driving Cost Optimization and Operational Efficiency

Monetizing data isn’t just about selling it or using it to impact sales. It’s also about using insight to make smarter and faster (in other words, more efficient) business decisions.

For example, a manufacturing company can use predictive analytics to identify weak links in its global supply chain that lead to disruptions. By anticipating said disruptions, the company can reduce its inventory cost by up to 20% and improve order fulfillment times across regions.

Another example is direct profitability achieved when companies cut their marketing spend by 25% but increase campaign effectiveness through consolidating the behavioral data of their customers and the effectiveness data of their running campaigns.

In both cases, the cumulative effects of these optimizations result in leaner operations, reduced waste, and more agile business functions, all of which directly improve net margins.

Securing a Lasting Competitive Advantage & Shareholder Value

Organizations that capture, analyze, and act on proprietary insight are capable of building a competitive advantage that’s incredibly hard to replicate, just like Netflix, Amazon, and Tesla. These companies are built on business models that rely on data to make faster, smarter, and more customer-aligned decisions compared to their respective competitors.

Want to see how your data can drive revenue? Don’t hesitate to book a free data audit.

Building a Data Monetization Framework

As previously stated, data monetization isn’t a one-and-done IT initiative, but a strategic implementation that has a maturity curve. Successful organizations follow a phased approach that evolves from the internal use of their data to externally monetized data offerings. Here’s a high-level look at a 3-phase framework:

- Phase 1: Internal Monetization—Internal monetization focuses on cost savings and efficiency gains. In this phase, data is used to optimize internal operations, including streamlining the supply chain, reducing downtime through predictive maintenance, or smarter marketing allocation. This phase lays the groundwork by providing data’s value through measurable ROI.

- Phase 2: Insight Monetization—This phase begins when data monetization practices move beyond operations into strategic intelligence. Organizations build dashboards, embed AI into workflows, and use advanced analytics for decision support. The goal is to empower teams with real-time insights that enhance agility, accuracy, and responsiveness.

- Phase 3: External Monetization—Phase 3 is the most mature phase, where data becomes a revenue-generating asset. Companies develop data products, such as dashboards, datasets, or embedded analytics, and expose insights through APIs, or form strategic partnerships.This might also involve launching a DaaS model, licensing analytics, or selling anonymized data to ecosystem partners.

This approach to data monetization starts with internal uses before expanding to external value creation, thus ensuring that the monetization efforts are both scalable and aligned with business priorities.

Industry Case Studies: Monetization in Action

While data monetization theory sounds compelling, the real value isn’t unlocked until the strategy translates into business outcomes. Industry leaders are now proving that data isn’t just a byproduct or a support function, but a core product and a decision engine that makes businesses grow. The case studies listed below show how companies can successfully monetize their data.

Retail Data Monetization

Retail businesses operate on the intersection of high-volume transactions and rich customer behavior data, which is a perfect recipe for monetization. One global chain launched an internal analytics division, which turned in-store purchase and movement data into licensed insight for CPG brands.

These brands, in turn, paid the company to learn which shelves converted best, which promotions worked across regions, and how shoppers actually navigated the space. All of this data is highly anonymized, but it’s still very actionable for the brands.

Banking and Financial Services

Data has always driven risk management and customer intelligence engines in the financial industry. However, external monetization options usually come in the form of using the data to develop a credit scoring engine based on payment behavior and mobile use, which is then licensed to fintech and micro-lenders in emerging markets.

Fraud detection models were also originally built for internal protections, but financial institutions are now using them as revenue-generating assets by licensing them to smaller institutions.

Healthcare and Life Sciences

Healthcare data monetization is a highly controversial topic because many perceive it as generating revenue from private healthcare data. However, in reality, the data is used in a way that reduces expenses and lowers risks, which still positively affect the net margin without actually generating revenue.

One hospital group formed a partnership with a pharma company to share anonymized clinical outcomes data. The pharma company then used this data to fine-tune its drug trial designs, thus accelerating time-to-market while compensating the data provider for the value of the provided data.

However, it’s important to note that all such data sharing must comply with HIPAA regulations and local data privacy laws, ensuring that patient identities are protected.

Lessons Learned and Common Pitfalls

Despite all the success stories, many organizations are still struggling to move from data-rich to data-monetized. Without robust data governance, quality issues and compliance risks run rampant, and can derail monetization efforts before they even start.

Reputational risks also loom large, and missteps in data use can lead to public backlash, as seen in cases like Target’s infamous predictive analytics incident. The issue of monetization without market research is also quite prevalent, as many businesses lack a valuation strategy. This leads them to attempting to monetize data without understanding its actual value, leading to underpricing or overpricing.

Successful monetization isn’t just technical; it’s organizational, which is why it needs support from leadership; otherwise, it will stall and eventually fail. This is particularly true in highly regulated industries, where legal and ethical constraints can severely limit monetization avenues if not carefully navigated.

Building a Resilient Data Monetization Ecosystem: Beyond Quick Wins

As previously mentioned, data monetization is a long game, and though it may provide some short-term wins, it’s not a sprint. To fully exploit the value of enterprise data, companies must build strong data management systems that are scalable, compliant, and above everything else, reliable. It’s not about monetizing your data faster; it’s about monetizing your data with strategic foresight and long-term scalability in mind.

The Foundation: Data Governance, Quality, and Ethics

No data monetization can succeed without good quality data, and organizations must ensure that their data is accurate, secure, and used ethically. Data quality is a prerequisite for generating reliable insights. Inconsistent and incomplete data lead to flawed decisions that not only impact revenue but also introduce risk.

Data privacy and security are also non-negotiable, period. Failure to respect privacy laws and strong security measures is bound to result in reputational and financial damage due to legal reasons. It’s also important to go beyond the bare minimum of compliance by being transparent, accountable, and customer-centric in your business’s data practices.

Strategic Partnerships & Data Ecosystems

Resilient data monetization doesn’t happen in isolation, and companies that treat data as purely an internal asset often miss opportunities that come from strategic collaboration. Put simply, external partnerships with data providers and analytics vendors often unlock new insights and revenue streams.

Industry-specific data consortia and data exchanges are also on the rise, and by building or participating in a broader data ecosystem, companies gain access to complementary data sets, new markets, and even shared infrastructures. These opportunities rarely present themselves when operating in isolation.

The Technology Backbone: Scalable Solutions & AI Readiness

Even the most compelling data strategy will fail without the right technology foundation (and the right talent behind that technology). As organizations scale their monetization efforts, they need platforms that are flexible, secure, and AI-ready. AI-driven insights are increasingly central to high-value monetization.

However, AI is only as good as the infrastructure behind it, so companies must build with future-proofing in mind. Besides being a processing powerhouse, that infrastructure also has to be scalable to allow the organization to expand and evolve.

Your Executive Roadmap: Implementing a Data Monetization Strategy

Despite its innate reliance on technology, your data monetization efforts start with leadership. CEOs and other C-suite decision makers must champion and sponsor data monetization efforts, adhering to a roadmap that balances vision, strategic goals, and execution. Here’s how to move from unrealized potential to organization-wide impact:

Step 1: Assess Your Data Assets & Opportunities

Before you can begin monetizing your data, it’s important to know what data you own. A data valuation exercise helps identify which datasets hold the greatest potential for operational gains, insight generation, or external revenue.

It’s also important to map out your data, where it’s stored, who owns it, and how it’s used. Most enterprises are already sitting on treasure troves of data buried across departments, disparate systems, and different formats.

CEOs should push for a cross-functional initiative that would break down these data silos and assess datasets, their value, and how can they be used to generate revenues.

Step 2: Develop a Clear, Aligned Data Strategy

Many organizations benefit from data strategy consulting to ensure their monetization goals align tightly with overall business objectives and that they adopt best practices in planning and execution.

Once you’ve analyzed and understood the data you already have, the next step is to align your monetization goals with your business strategy. Monetizing data for its own sake is a recipe for wasted resources. Instead, these initiatives have to tie directly into broader organizational objectives. This requires executive-level clarity on:

- Desired outcomes, like new product lines, faster decision-making, and improved operational KPIs

- Monetization models, like the aforementioned direct or indirect model

- Time horizons

Most importantly, the data monetization strategy has to be measurable, so it’s a good idea to establish concrete KPIs, such as revenue generated from data products, cost savings from analytics, or improvements in customer retention. This ensures your strategy’s effectiveness, as well as accountability.

Step 3: Pilot, Learn, and Scale for Sustained Impact

We’d like to reiterate that data monetization isn’t a one-time project that results in a massive transformation. Instead, it’s an iterative, learn-as-you-go process that begins by identifying a use case with a strong ROI potential and executive buy-in.

The goal of the pilot is to prove value quickly, validate the strategy, build internal momentum, and strengthen interdepartmental collaboration. From there, successful models should be expanded to other departments, regions, or partners, all the while continuously optimizing based on feedback and results.

It’s important to remember that a sustainable data monetization strategy is never static; it evolves with the technology, market conditions, and enterprise maturity.

Realizing the Future: Your Data-Powered Enterprise

Data monetization isn’t just a passing trend, but a foundational shift in how modern organizations drive profits, efficiency, and innovation. For forward-looking leaders, the opportunity lies not just in collecting data but also in using the collected data as a strategic asset.

The time to act is now; if you want to transform your data into revenue, speak with our Data Expert today!