Real-time decision-making has become the holy grail of modern business strategy. But speed without trust is risk. Many organizations race to implement real-time dashboards, alerts, and automations, only to realize too late that the underlying data can’t support them.

Hidden data gaps like missing fields, outdated integrations, and conflicting definitions are easy to overlook but deeply costly. Before organizations can act faster, they need to act smarter. That starts with developing a clear data strategy that identifies where their data falls short and outlines what it takes to close the gaps.

What Are Hidden Data Gaps?

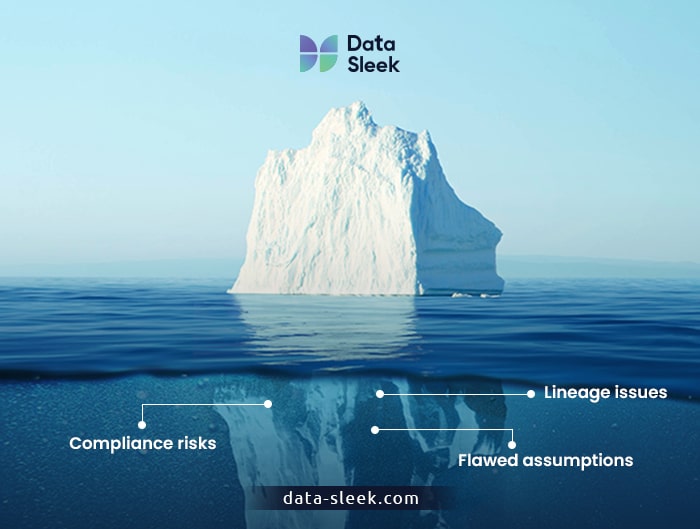

In today’s digital enterprise, dashboards refresh by the second, teams are empowered to act on live insights, and alerts fire in real time. Yet, beneath this agility lies a hidden risk: data gaps. These are the inconsistencies, blind spots, and disconnects within an organization’s data infrastructure that silently erode decision quality.

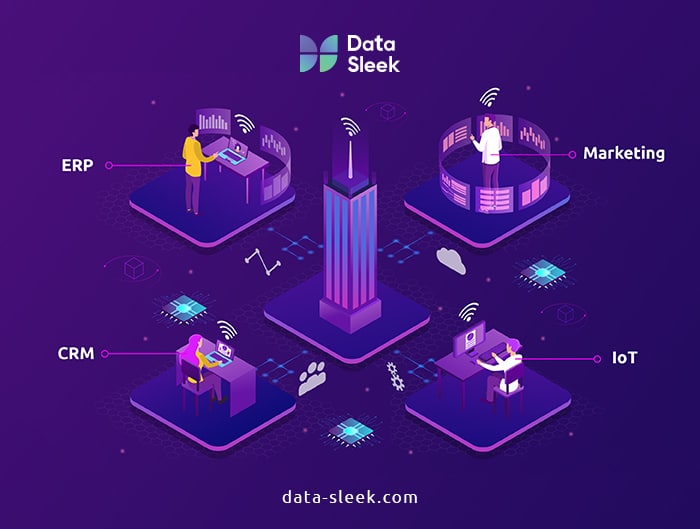

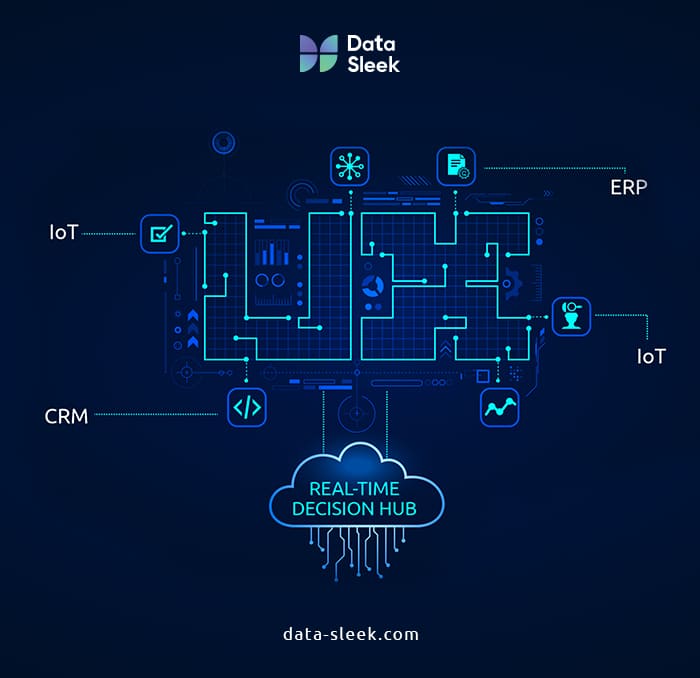

Data gaps aren’t always obvious. An enterprise might have modern tools, but if its CRM doesn’t sync with its ERP, or its IoT sensors stream into isolated silos, this only results in the executive basing decisions on partial truths.

Below, we explore a crucial issue facing modern businesses: real-time decision-making is only as good as the data feeding it. And for too many businesses, the data is inconsistent, fragmented, or simply missing in action.

If your organization’s strategy depends on fast, data-driven action, but the foundation is unreliable, you’re not only moving faster, but also blind.

Why Real-Time Decisions Depend on Clean, Integrated Data

Real-time decision-making offers faster time to market, agility, and a sharper competitive edge. But what happens if the data driving these decisions is delayed, fragmented, or wrong?

Some organizations assume that if a dashboard updates every five seconds, the insights are sound. However, time isn’t just about speed; it’s about consistency, accuracy, and integration. Without these foundations, fast decisions can quickly become expensive mistakes. Here are four risks that arise when data gaps go unnoticed.

Wasted resources

Real-time actions cost money, whether through ad bidding, dynamic pricing, or routing. McKinsey reports that midsize companies can spend over $250 million annually on data sourcing, architecture, governance, and consumption. By addressing inefficiencies like redundant feeds or outdated platforms, organizations can cut data costs by 5–15% in the short term and nearly double that with deeper modernization efforts.

Example: A retail chain uses predictive analytics to launch region-specific promotions based on historical sales. However, because of synchronization delay in point-of-sale systems, several stores still reflect last quarter’s inventory levels. This results in some promoted products being out of stock, thus wasting ad spend and frustrating customers.

Wasted resources don’t arise due to total system failure; they are from subtle data misalignment. That’s what makes the gaps disastrous since they’re invisible until the damage is done.

Regulatory exposure

When data powers decisions, it also underpins compliance. Inconsistencies, gaps, or missing lineage can cause companies to report inaccurately, even without realizing it.

Example: A financial institution relies on automated transaction monitoring for AML compliance. But due to integration issues between its core banking platform and a newer analytics engine, certain high-risk transactions don’t trigger the necessary red flags. This kind of breakdown isn’t hypothetical. Citigroup paid a $136 million fine after regulators found it had submitted faulty data during a stress test, a lapse rooted in weak internal controls and flawed data infrastructure.

Decision makers may assume compliance checks are reliable and automated until hidden data gaps prove otherwise.

Customer dissatisfaction

Nowadays, customers expect immediate, personalized service. Even so, real-time personalization requires unified customer profiles, and they can’t exist without integrated and trustworthy data. Without it, you risk suggesting upgrades mid-interaction to someone still battling a billing issue.

According to McKinsey, companies that excel at personalization generate 40% more revenue from those activities than their average peers, while 76% of consumers get frustrated when they don’t receive personalized experiences.

Example: A telecom provider uses AI to recommend upgrades mid-interaction. But its CRM isn’t fully integrated with the support system, and the AI suggests an upsell to a customer still waiting for a billing dispute to be resolved. This interaction ends up feeling tone deaf and antagonizes the customer.

Missed opportunities

When data pipelines don’t deliver complete or timely insight, companies hesitate or act too late. In the real world, these delays mean that missed signals often lead to missed revenue.

Example: A logistics company deploys a dynamic routing algorithm for last-mile deliveries. However, GPS data from half its feet is delayed because of API throttling in the vendor’s service. As a result, the algorithm can’t reroute in real time, leading to delivery delays and costly SLA penalties.

Beyond the Dashboard: Common Culprits Behind Your Data Blind Spots

Even though dashboards refresh in real time, they can’t reveal what’s missing beneath the surface. Most data blind spots originate not from technology failures, but from structural and strategic weaknesses that accumulate over time.

These are the most common and often most overlooked culprits.

The Peril of Data Silos

When data is trapped in departmental systems like marketing, sales, finance, or operations, insights become fragmented. Each team sees a different version of reality, and executive decisions are made without the full picture.

Silos create duplication, delay, and misalignment. They also prevent organizations from asking more complex, cross-functional questions like how support issues affect revenue or how marketing performance influences operational load.

Why Your CRM Isn’t Talking to Your ERP

One of the most critical disconnects in enterprise architecture is the gap between CRM and ERP systems. CRMs track customer behavior and interactions; ERPs track billing, fulfillment, and product availability. But when these systems don’t speak to each other, decisions about pricing, customer strategy, or inventory suffer.

These integration issues are common, especially in organizations managing hybrid tech stacks or legacy infrastructure. The resulting blind spots often surface as inaccurate forecasts, fulfillment delays, or customer experience breakdowns.

Inaccurate, Inconsistent, and Outdated Data

In real-time systems, speed magnifies even small inaccuracies, triggering false alerts, distorted KPIs, and misguided automation.

With duplicated records, updates don’t sync consistently, and formats might vary by source, thus eroding trust. Teams begin second-guessing analytics outputs and rely on manual workarounds. This slows decisions and increases operational risk.

Only 3% of companies’ data meets basic quality standards, highlighting just how widespread and underestimated this issue is, even among enterprises investing in analytics maturity.

The Cost of “Good Enough” Data

Most enterprises accept minor data flaws like missing metadata, 24-hour sync lags, or incorrect labels as a cost of doing business. However, those “good enough” assumptions are dangerous at scale. When thousands of small inaccuracies ripple through analytics systems, strategic decisions rest on unreliable foundations.

Real-time systems require a higher standard. Therefore, precision is what matters, not perfection. This results in consistency and accuracy across every data entry point.

Lack of Strategic Data Governance

Some organizations treat data governance as a compliance box to check. Yet, without strong governance, organizations lose control over how data is defined, used, and trusted.

Teams struggle to align when data lineage is unclear. Data lineage refers to the record of where data originates, how it is processed through systems, and how it changes during this process. The problem is compounded when KPIs lack standardized definitions and when there is no formal stewardship model in place.

Who Owns Your Data’s Integrity?

Lack of clear ownership is a common failure point in most companies. Everyone assumes someone else is responsible for data quality. As a result, errors persist until they become visible at the executive level, by which time the damage has scaled.

Strategic data integrity requires defined accountability, not just technical tools. Executives must assign ownership, champion policies, and embed governance into business processes, not just IT workflows.

Real-Time Use Cases and Where Data Gaps Cause Failure

Real-time analytics is only as powerful as the integrity and completeness of the data behind it. Across industries, organizations invest heavily in real-time infrastructure, only to be undermined by unseen data gaps that sabotage decision-making at the moment it matters most.

Below are four industry use cases that reveal how even advanced real-time systems can break down when data is fragmented, missing, or poorly integrated.

Transportation

Transportation networks increasingly rely on real-time data to reduce delays, optimize routes, and keep fleets in service longer. But even with onboard sensors, GPS trackers, and scheduling software in place, gaps between data sources create operational blind spots.

When ridership data isn’t integrated or vehicle telemetry doesn’t sync with route-planning systems, the result is reactive maintenance and inefficient dispatching. GPS trackers, RFID tags, and TMS software may provide partial visibility, but full end-to-end insight remains elusive. McKinsey reports that while 60 percent of companies have visibility into direct suppliers, only 30 percent can see two tiers deeper into their network.

This highlights that telemetry and routing systems still leave supply chains blind in critical areas. Without full visibility, transportation teams react to issues instead of anticipating them, which undermines real-time effectiveness.

Insurance

In the insurance sector, real-time analytics is a critical line of defense against fraud and poor underwriting decisions. However, success hinges on the ability to combine policyholder data, claims histories, and third-party inputs like medical records or weather reports.

If these sources are updated asynchronously or siloed, they lead to unreliable risk scores. Fraud detection algorithms may generate false positives or miss crucial patterns. Therefore, valid claims may be delayed or denied, while fraudulent activity escapes notice.

The impact is significant: slower service, rising loss ratios, and diminished customer trust, all rooted in incomplete or poorly connected data. A 2022 FRISS study of over 400 insurers reinforces this, identifying the lack of access to real-time data as one of the top barriers to effective fraud prevention.

Healthcare

Real-time patient monitoring systems in critical care units are designed to trigger alerts the moment something goes wrong. But these systems depend on consistent, well-integrated data from lab systems, telemetry devices, and electronic health records (EHRs).

Alert systems can fail when there’s lag in telemetry data or when patient identifiers differ across platforms. The result? Missing critical thresholds entirely or sending inaccurate warnings. This forces healthcare staff to manually reconcile data streams in high-stakes situations, increasing liability risk and slowing down interventions.

A case in point is Epic’s proprietary sepsis prediction algorithm, which was the subject of a 2021 study by University of Michigan researchers. The study, as reported by Wired, found that the algorithm missed two-thirds of actual sepsis cases, rarely caught the ones clinicians had missed, and frequently issued false alarms.

This illustrates how flawed real-time alerting rooted in poor data integration can compromise patient safety.

Higher Education

Universities are turning to real-time analytics to improve student outcomes like financial aid disbursement and enrollment optimization. However, most still struggle with fragmented data ecosystems.

CRMs, Student Information Systems (SIS), and financial aid platforms often operate independently, resulting in missed triggers and manual intervention. Predictive models meant to flag at-risk students often fail when behavioral data isn’t connected, resulting in poor satisfaction, delayed support, and drop-offs.

A 2024 study published in The Internet and Higher Education found that student disengagement is strongly linked to low satisfaction and poor self-regulation. These factors are often worsened by a lack of system feedback and support. These outcomes are harder to address when institutions rely on outdated or siloed systems that prevent real-time visibility.

How to Identify and Close the Gaps

Most data gaps aren’t visible in dashboards because they live deep within inconsistent pipelines, disconnected systems, or undocumented handoffs. Fixing them requires more than reactive patchwork.

It calls for a deliberate, organization-wide approach to measuring, mapping, and modernizing an organization’s data foundation.

Step 1: Conduct a full data inventory

This entails identifying every data source across the organization, including SaaS tools, cloud platforms, legacy systems, and on-prem databases. The process is strategic because it is a foundational step in building a data strategy roadmap, helping you understand where data lives, who uses it, and what it feeds.

It’s crucial to also include spreadsheets, shadow systems, and API-dependent platforms. These often harbor critical business data that’s invisible to enterprise architecture diagrams but influential in day-to-day decision-making.

Step 2: Assess data quality and lineage

Real-time systems depend on traceable, timely, and accurate data. Evaluate data for freshness, consistency, completeness, and duplication. More importantly, map the lineage: where does each data point originate, and how does it transform along the way?

This is essential for building trust. If executives can’t trace a KPI back to its root source or if that source is unreliable, then even the most beautiful dashboard will be ignored.

Step 3: Map dependencies and access patterns

Identify how different teams and systems rely on your data in practice. Which integrations or APIs are lagging or fragile? Which processes depend on live data versus batch updates? This process helps surface latency issues, bottlenecks, and redundant data flows.

It also forces organizations to challenge assumptions like whether systems are truly “real-time” or just updated frequently.

Step 4: Implement data governance and observability

Governance provides structure. Data observability, which is the ability to continuously monitor and understand the quality, freshness, and flow of data across pipelines, ensures that quality issues are detected before they impact decisions.

Define clear policies around data ownership, definitions, access controls, and stewardship. Furthermore, deploy observability tools that monitor data pipelines in real time, tracking anomalies, freshness, and system failures before they impact decisions.

Step 5: Build a scalable architecture for real-time analytics (e.g., cloud DW + streaming)

Lastly, invest in the infrastructure that supports seamless, real-time decision-making. This often means a modern data stack: streaming platforms, cloud data warehouses, and event-driven architectures, where systems communicate and respond to real-time data events as they occur. But organizations must note that technology alone isn’t enough. It must be built with maintainability, flexibility, and cross-functional alignment in mind.

With a scalable architecture, business needs evolve, and data systems can respond without compromising quality or speed.

Why Data Gaps Are a Strategy Problem—Not Just a Technical One

In most cases, data issues are labeled “technical debt” and handed off to IT. But in reality, data gaps undermine core business strategy, including compliance, revenue forecasting, customer experience, and innovation. This isn’t a tooling problem. It’s a leadership challenge. Here’s why:

- Misaligned teams equal misaligned decisions: If finance, sales, and marketing all use different definitions of “active customer,” they will disagree on performance and act on competing realities. In the 2022 NewVantage Partners survey, over 91.9 percent of executives named culture, people, process, or organizational alignment as the primary barrier to becoming data-driven, rather than technical limitations.

- Unclear ownership means delayed accountability: When no one is explicitly responsible for data quality, errors remain unfixed. Gartner highlights that a key barrier to implementing enterprise-wide data quality programs is the “lack of ownership,” commonly rooted in scarce resources and unclear accountability.

- Speed without trust leads to risk: Fast decisions on flawed data lead to compliance exposure, mispricing, and eroded customer confidence. Speed only works if it’s backed by integrity. Gartner estimates that poor data quality costs organizations an average of $12.9 million per year, affecting compliance, operational efficiency, and decision accuracy.

- Silos are cultural: Collaboration breaks down when teams protect their metrics or systems. Fixing this requires executive-level alignment on shared goals and outcomes. McKinsey research shows that data-driven organizations with strong governance are more agile and make faster, better decisions, while those with siloed data and unclear ownership fall behind.

Your Next Step: Transforming Data Challenges into Strategic Advantage

Every organization deals with some level of data chaos, but the real difference is how leaders respond to it. Treating hidden data gaps as isolated glitches or technical noise is a missed opportunity. Instead, forward-thinking enterprises should see them for what they are: signals.

Signals that your systems are growing faster than your structure. Signals that your data needs to scale with your ambition. By proactively addressing these gaps, you reduce risk and gain an edge. With trustworthy, unified, and real-time data, companies can:

- Spot opportunities before competitors do

- Deliver consistent, intelligent customer experiences

- Empower every team to act on shared, accurate insight

- Accelerate digital initiatives with less friction and rework

Getting faster isn’t the goal. Getting it right-at speed-is. Talk to a data strategy consultant today.

FAQs on Data Gaps and Executive Dashboards

How do data gaps affect real-time decision-making?

Real-time outputs can mislead if the data beneath them is broken. Gaps in accuracy, consistency, or integration create blind spots that erode trust, misguide decisions, and increase business risk.

Can you have real-time dashboards with incomplete data?

Technically, yes, but it’s dangerous. A dashboard can update in real time and still show outdated or partial data if its sources aren’t fully integrated. What looks like “live insight” can actually be a high-speed illusion. Speed without completeness just invites risk.

What’s the difference between dirty data and a data gap?

Dirty data refers to inaccuracies like duplicates, typos, or formatting errors. On the other hand, a data gap refers to missing or disconnected information, such as integrations that don’t sync, entire fields not captured, or systems that don’t communicate. Both degrade decision quality, but gaps often go unnoticed longer.

How do data gaps lead to flawed business decisions and missed opportunities?

When systems don’t capture or surface all relevant data, leaders act on incomplete context. This could mean pricing a product without real-time supply costs, launching a campaign without full customer behavior data, or approving risk without full exposure visibility. The result: wasted resources and lost revenue.

What risks do organizations face when decision-makers rely on incomplete data?

Incomplete data leads to operational inefficiencies, compliance risks, and flawed decisions. Teams lose trust in dashboards, KPIs become unreliable, and rework increases. Leaders, contrarily, act on partial truths since they have limited visibility. This results in missed opportunities and customer dissatisfaction. Over time, these gaps slow execution, drain resources, and erode strategic confidence across the business.

In what ways do information gaps increase compliance risks and resource drain?

Compliance often requires traceable, accurate, real-time reporting. Data gaps, especially those hidden in integrations or lineage, can lead to audit failures, misreporting, and legal exposure. On the operational side, gaps force teams to double-check, rework, or manually reconcile decisions, pulling time and resources away from strategic execution.