Introduction

Insurance is typically defined by calculated risks, actuarial tables, and where a single misplaced decimal can mean success or failure. Given that AI has been successfully used across other commercial sectors for marketing, data collection, and customer satisfaction, insurance agencies are doing the same. This insurance industry strategy is crucial for managing increasing amounts of data for both claims and policyholders while maintaining strict data governance in a field where precision is critical to make informed and actionable decisions.

What Is Data Governance in Insurance?

In the context of insurance data management, data governance means setting up a combination of technology, procedures, and corporate policies under the auspices of data stewards, a governance team, and a steering committee to develop a framework for data governance and ensure oversight, accountability, and collaboration.

Data governance is most effective when implemented alongside an insurance data warehouse that provides centralized visibility, control, and audit capabilities.

There are several obvious benefits for the insurance industry’s digital transformation, including automation of fraud detection, giving your customers access to online portals for claim submission, software to make managing existing claim easier, and much more:

- Algorithms to assist in the creation of automated claim estimates based on contextual data from policyholders.

- Blockchain and smart contract integration in the property and casualty (P&C) insurance market provides greater transparency for customers, and

- Digital adoption platforms and their use by insurance agents leads to increased productivity and performance, and telematic technology that analyses data sent and received that helps insurance companies track vehicle locations, monitor driver behavior, fuel usage, and speed of travel.

- Omnichannel communication platforms for combining multiple methods of interacting with customers into a single tools, and policy portals for your customers to review policy information, file claims, and reach agents.

- Predictive insurance analytics, which is a combination of statistical models, data analysis, and machine learning that improves the efficiency of processing claims, risk assessment, and fraud detection.

Why Insurance Companies Need Strong Data Governance

Regulatory pressure (HIPAA, GDPR, NAIC Standards, etc.)

While all businesses require compliance to their respective national laws to a greater or lesser extent, sound insurance data strategy must ensure adherence to governmental data requirements, especially if your business is multinational and thus subject to several laws. Prominent examples of laws that insurance companies must comply with include the Health Insurance Portability and Accountability Act (HIPAA) in the U.S., the E.U.’s General Data Protection Regulation (GDPR), South Africa’s Protection of Personal Information Act (PoPIA), the National Data Privacy Agreement (NDPA), and the National Association of Insurance Commissioners (NAIC), a professional organization based in the US that sets standards for the industry. Failure to adhere to the standards of any or all of these laws and regulatory bodies can result in severe consequences. These could onerous financial penalties, the loss of accreditation with a governing body, and even negatively impacting the public reputation of your business.

Implementing strong governance policies helps insurers satisfy compliance requirements through built-in audit trails and data lineage, ensuring adherence to HIPAA, GDPR, and state insurance regulations.

Fraud detection and prevention

According to the Coalition Against Insurance Fraud (an alliance between consumers, government agencies, insurance groups, and legislative bodies), a 2023 report from the group evaluated the estimated cost of insurance fraud in the U.S. for the first time since 1995. In the intervening three decades, the total amount of money wasted on insurance fraud went from $80 billion to $308 billion, a staggering increase of 285%. Given that fraudsters are likely to take any advantage granted to them by technology, insurance companies must respond in kind by incorporating AI-driven predictive analytics, which combine the power of machine learning, historical data, and statistical models to uncover cases of fraud and identify fraudulent activity automatically. Using AI helps companies with their day-to-day business, with benefits which include faster, more accurate, and more proactive fraud detection. It also improves overall customer satisfaction, requires less human intervention and frees up teams for higher value tasks, and can generate significant cost savings over time.

Customer data privacy

Failing to adhere to various governmental standards can come at a significant cost, and this is especially true when dealing with issues related to customers’ data and its privacy. Having your customer data become compromised not only opens up a company to penalties for not having proper safeguards in place, it also places it at risk for potential litigation. The combination of governmental penalties with the potential for individual or class-action lawsuits as well as the hit to public reputation makes for a possibly ruinous situation for an insurance company, so incorporating the appropriate technology to safeguard customer data should not be ignored.

Risk modeling and underwriting efficiency

In addition to ensuring that your insurance business stays in compliance and avoids any related issues, incorporating advanced technology like AI in your insurance data strategy also provides greater efficiency for underwriting and performing complex tasks like risk modeling. Both underwriting and risk modeling are pillars of the insurance industry. Underwriting deals with risk assessment of property to determine any risks, the cost of an associated policy, and whether or not to accept an application. Risk modeling involves the creation of complex, data-driven predictions to determine risks for specific markets, detect illegal activity including money laundering and insurance fraud, and simplify assessment of lending risks and assessing customer credit.

Claims management accuracy

Since the industry is especially dependent on the accuracy and quality of its information, data governance in insurance helps ensure that claims management is efficient and optimized. Incorporating data analytics and investing in the appropriate technology, your business can enjoy the benefits of minimizing the need for human intervention, allowing your agents to focus on tasks with higher value and greater impact thanks to a notable reduction in cycle time. By allowing sophisticated AI tools to access insurance data management, your business can greatly improve both its profitability and its reputation.

Key Challenges in Insurance Data Governance

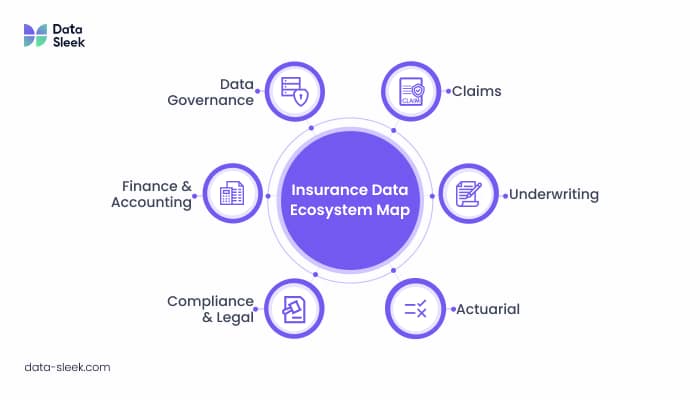

Siloed data across departments (e.g., underwriting, claims, actuarial)

Much as the name implies, siloed data refers to files and information stored separately to other departments, such as actuarial, claims, and underwriting. By keeping the data isolated and not allowing it to be used for comparison or algorithmic software integration, your company will be unable to get a complete picture of your corporate data.

Breaking down data silos ensures that employees have more time to deal with urgent tasks, thanks to the greater departmental cooperation improved efficiency when making actionable decisions. For insurers ready to tackle these challenges, Data-Sleek offers purpose-built insurance data solutions that unify siloed systems, modernize legacy platforms, and establish governance frameworks that drive long-term operational efficiency.

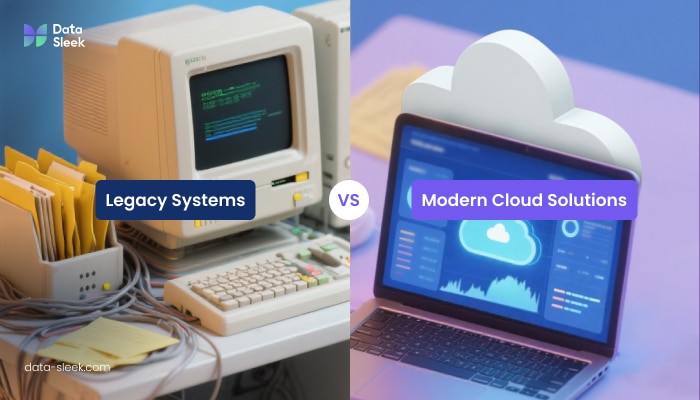

Legacy systems

Despite the inherent desire for businesses to stick to established principles and software, doing so can lead to enormous problems for your company:

- Outdated security systems are not only ineffective, they are a potential liability as seen with British Airways GDPR fines for failure to properly secure their customer data,

- Older technology often suffers from inefficiency and poor performance, including data bottlenecks, increased system downtime, and problems with scalability when the need arises.

- Maintaining legacy systems often requires outdated hardware, niche technical knowledge, and specialized staff – costing more than upgrading in the long run.

- Many legacy systems simply lack compatibility with modern technology, which leads to operability issues, cause problems with communication across departments, and not being able to utilize certain features of software due to incompatibility.

- Problems with data consistency and integrity are often encountered when using legacy systems, including data loss, corruption, and redundant or duplicate data, causing inconsistencies that cost unneeded work-hours to resolve.

- Difficulties in keeping data compliant with current standards often arise from legacy systems thanks to a lack of modern features and security. As mentioned above, any issues with data compliance can cause financial penalties, expensive overhauls, and a loss of public confidence.

Unstructured vs. structured data

Structured and unstructured data each present unique challenges and opportunities, as well as distinct approaches to organizational data governance. Structured data is easier to analyze and integrate; however, compatibility issues frequently arise and maintaining data quality requires ongoing efforts. Unstructured data, which holds rich insights for advanced technology, requires specialized tools for detailed analysis and also poses difficulties in organization and retrieval, as its lack of a standard format complicates integration efforts.

For insurers managing high volumes of policy documents, claims files, and correspondence, intelligent document processing introduces structured extraction, classification, and validation workflows that bring unstructured data into a governed framework. Any cultural resistance within your business hinders the shift toward a data-driven culture, affecting the quality of both types of data.

Structured data must comply with strict data governance regulations (e.g, HIPAA, GDPR), which necessitate additional costs to ensure proper data handling. Unstructured data requires sophisticated data management strategies and advanced technology for safeguarding sensitive information and utilizing any data resources effectively.

Real-time access and analytics demands

The insurance industry requires greater real-time access to data as well as advanced analytics to enhance their decision-making and customer experiences. However, there are several issues to address for this to occur.

Data integration is a major obstacle, as combining both structured and unstructured data be complicated by differing formats and quality, especially when dealing with multiple data sources. High-quality data is essential to avoid poor decisions, thus requiring continuous monitoring and cleaning to prevent issues from arising.

Regulatory compliance with laws like HIPAA and GDPR adds complexity and costs to data management. Cultural resistance within organizations can also slow the transition to a data-driven approach, especially in those less accustomed to analytics.

While many advanced analytics tools are available, your company has the necessary infrastructure or resources for effective implementation. Increased data access inevitably increases the risk of your cybersecurity becoming compromised. This increases the need for strong security protocols to keep any sensitive information protected. While the push for real-time analytics in insurance is strong, navigating these challenges is crucial for success.

Core Pillars of Effective Insurance Data Governance

Data Ownership & Stewardship

Having effective insurance data governance depends on assigning clean ownership roles across business units. Doing so establishes a strong framework for managing your company data effectively. Each unit must have a designated data steward responsible for overseeing the quality, usability, and security of all data they handle. Not only does this ensure accountability, it also ensures alignment with specific departmental needs. Any data owners must regularly assess their data quality through company-approved validation and cleansing processes. They must also comply with any relevant regulations mentioned above, and control access well-defined for user roles, preventing unauthorized access to corporate data.

Data owners should be actively engaged in managing the entire data lifecycle, thereby collaborating with stakeholders to understand their data needs and fostering a culture of data-driven decision-making. By having clearly defined data ownership roles, your insurance company can implement an organized and effective data governance strategy. Doing so is critical for enhancing decision-making and improving customer experiences while navigating industry complexities.

Metadata Management

Creating a robust metadata management strategy is essential for efficiently managing policy, claims, and customer data within your insurance company. The process of metadata management means organizing data assets. This is accomplished by noting key metadata including data source, type, format, and ownership. Implementing a specific tagging system is key for categorizing your data based on its type and sensitivity. Using a set of standardized definitions for metadata helps all employees improve their understanding as well as communication between departments.

By appointing data stewards, your company can ensure that its metadata is accurate and up-to-date as well as being in compliance with any relevant regulations. By training employees how to utilize the new metadata catalog, it helps foster a data-driven culture which results in more informed decision-making. Prioritizing metadata management enhances access to critical data, which in turn improves both customer experiences and informed decision-making processes.

Data Quality Controls

Effective insurance data governance is crucial for maintaining data integrity, security, and usability. Data quality controls should focus on establishing validation rules as well as data lineage as essential components to the overall process. Validation rules are designed to ensure that the data collected is accurate and reliable by implementing checks such as format validation, acceptable value ranges, cross-field validation, and mandatory field requirements. Said data validation reduces the occurrence of data errors, facilitating the flow of high-quality data into systems and supporting better decision-making.

An established data lineage provides a comprehensive view for your company of its data lifecycle, which enables your organization to track information throughout creation, transformation, and usage. Key aspects of data lineage include identifying data sources, documenting transformations, and monitoring data usage. Having a clear data lineage will enhance your company’s compliance as well as help to facilitate identification of any potential data quality issues, and streamline your change management processes. These practices empower insurance companies to leverage their data effectively, helping to foster trust in their information assets, ultimately driving better business outcomes.

Policy Enforcement & Compliance

An effective enforcement of insurance data governance policies is crucial for maintaining data compliance. Automating audits and alerts improve your company’s efforts by continuously monitoring data practices and checking for strict adherence to governance standards. Implementing automated systems can track data access, monitor relevant quality metrics, and send real-time alerts for any policy violations. A proactive approach enables your business to mitigate risks of data breaches while also fostering improved accountability within your organization. By maintaining high data integrity and security standards, automated audits ensure that governance policies remain enforced.

Data Governance Framework for the Insurance Industry

A data governance framework helps create a flexible system by bringing together people, processes, and tools. The process includes forming a cross-functional team to implement governance policies, setting up standardized data handling processes, and using tools for monitoring and reporting. Any framework should highlight the importance of connecting governance tools with CRM, improve efficiency of claims management, and that any underwriting platforms ensure policies are applied consistently. Custom workflows should also include validation checks to meet corporate governance standards.

Embedding governance policies into automated data pipelines enables compliance checks at every stage, with regular reviews in place to help adapt to evolving corporate and governmental regulations. A comprehensive approach enables your insurance companies to enhance its data management strategies as well as ensure compliance, security, and accountability.

See how governance-first data architecture delivered results in our Tradesman case study, where compliance reporting became a real-time dashboard process.

Data Governance Dimensions vs. Data Quality Metrics vs. KPIs

Data Governance Dimensions

Data governance in the insurance industry involves key elements including accessibility, accountability, and policy enforcement to create effective data management.

Data Quality Metrics

Accessibility allows authorized users to access data, while accountability defines roles in data governance. Key data quality metrics include accuracy, completeness, consistency, and timeliness. These four metrics help ensure that all your corporate data is correct, available, and delivered when needed.

Data Governance KPIs

Important KPIs for data governance include percentage of data sources under governance, percentage of compliant records, and the frequency of policy violations. These metrics help organizations enhance compliance and improve their data management practices.

How Data Governance Supports a Modern Insurance Data Strategy

Data governance is vital for a modern insurance company’s data strategy, as it simultaneously enhances both quality and accessibility to support analytics and AI/ML risk models. Ensuring any data driving these models is accurate and timely, organizations can improve underwriting practices. Effective data governance enables insurance companies to gain deeper insights into their customers’ preferences. Said insight results in more personalized offerings and enhanced customer engagement. A robust data governance framework improves your corporate decision-making processes, allows for more accurate risk assessment, and creating custom-tailored solutions that resonate with clients.

Future Outlook: The Role of Governance in AI & Predictive Insurance Models

As the insurance industry begins to integrate AI, machine learning, and predictive models heavily, data governance is becoming increasingly crucial. When ensuring that any technology is used both ethically and practically, particularly in addressing legal and compliance concerns, this is of utmost concern. Establishing a reliable data governance system fosters trustworthiness within your organization by prioritizing fairness, accountability, and data transparency.

This transparency helps prevent biased outcomes that may occur during any data review. Regulatory compliance is crucial for insurance companies, particularly since insurers are incorporating AI for decision-making. This digital transformation necessitates your company to develop a data governance framework that fosters ethical responsibility.

Data traceability and clarity are vital since insurers must track data sources and ensure their model transparency to client and stakeholder trust. Strict data documentation and interpretation standards allow insurance agencies to enhance public confidence in their AI-powered solutions. Developing effective governance for AI and predictive insurance models allows your business to improve your company’s ability to develop innovative, reliable, and customer-focused products that meet evolving market requirements.

At Data-Sleek, we specialize in untangling complex database challenges in cloud environments. If your team is dealing with replication bottlenecks, unresponsive applications, or database tuning issues, book a free consultation call with our consultants.

Our Insurance Data Warehouse Consulting team helps carriers establish governance frameworks that scale with their data growth while maintaining compliance.

Visit us at: https://www.data-sleek.com

FAQs:

What are the 3 pillars of data governance?

As the insurance industry increasingly adopts AI and predictive models, effective data governance is vital, helping your company ensure ethical, practical technology use, and addressing legal and compliance issues. A strong data governance system builds trust within your organization by emphasizing the three pillars of fairness, accountability, and transparency.

What is product governance in insurance?

Product governance in insurance involves the processes that ensure insurance products are designed, developed, and managed. This process is designed to meet regulatory requirements and customer needs throughout the entire product lifecycle. The lifecycle includes creating products, prioritizing consumer protection, adhering to legal regulations for risk mitigation, and identifying potential product-related issues. Continual monitoring and review assist your company by assessing product performance and making necessary adjustments, while transparency involves providing your customers with clear information about product features and cost options. Instituting effective product governance ultimately builds customer trust in your business, enhances internal accountability, and supports your long-term business sustainability.

How does data governance improve risk assessment in insurance?

Data governance enhances risk assessment in insurance by ensuring that your data is high-quality, consistent, and fully integrated. These three principles will lead to more reliable risk analyses, while standardized definitions maintain uniformity for better comparisons. Through combining data from various sources, your company gain a comprehensive view of risks, and robust governance ensures you remains compliant with relevant regulations while mitigating legal and financial risks. Access control protects sensitive information from being leaked and reduces the risk of breaches. Regular monitoring and audits help to identify gaps in your data and allow for immediate correction. Data governance also provides for advanced analytical capabilities and precise risk predictions, which empower stakeholders to make informed and effective risk management decisions. Overall, a strong data governance framework significantly improves the accuracy and effectiveness of risk assessment for the insurance industry.

What are the main regulatory challenges for insurers’ data management?

Insurers face several regulatory challenges in modern data management. One of the most significant is remaining in compliance with complex data protection laws like GDPR and HIPAA which can be resource-intensive. Implementing strict access controls while accommodating business needs is another challenge, along with establishing clear data retention policies for secure disposal. With the varying interoperability standards across regions that complicate compliance efforts, it is especially cumbersome for insurers operating in multiple jurisdictions. Additionally, meeting stringent regulatory reporting requirements demands accurate and timely data management, and regular audits require rigorous documentation and monitoring of data processes. Adapting your business to evolving cybersecurity regulations also allows your company to integrate crucial tools for robust data protection. This is especially important given that insurers must be agile to respond to new rules and amendments. These challenges highlight the necessity for a strong data governance framework along with ongoing investment in technology and training.

How can insurers overcome legacy system data integration issues?

Insurers can overcome legacy system data integration issues by implementing several strategies, starting with assessing and mapping data across your legacy systems to identify integration points for their new data platforms. Middleware can help your business standardize its data formats and facilitate communication between disparate systems, while also developing APIs that allow for real-time data exchange between legacy and modern applications. A phased migration approach can ease the transition of functionalities to new systems, and creating a data warehouse consolidates information for a unified view. Any legacy systems should ideally be replaced and upgraded with cloud-based solutions (budget permitting) to enhance your company’s overall integration capabilities. By engaging with new technology partners to provide necessary expertise and ensuring staff are trained on new systems, you can make the transition as smooth as possible. Establishing strong data governance policies is also critical for maintaining your data integrity and quality over time. Your business should also continuously monitor and evaluate its data system performance to allow for timely adjustments as needed. Together, these strategies help insurers effectively integrate data from legacy systems and enhance their overall data management.

Why is transparency in data handling vital for customer trust in insurance?

Transparent data handling is essential for building customer trust for your business. Establishing clear communications about data practices reassures your customers that their information is safe. This allows your customers to alleviate any concerns about data breaches and leaks stemming from misuse. Moreover, being open about data handling helps insurers comply with regulations like GDPR, avoiding legal issues and enhancing accountability. Data transparency empowers your customers by giving them control over their data, while also managing expectations and preventing misunderstandings potentially causing distrust. Transparent data practices not only improve customer satisfaction but also encourage positive engagement, making it crucial for success in the insurance sector.

What key capabilities are essential for effective insurance data governance?

Key capabilities essential for effective insurance data governance include:

* Implementing rigorous data quality management increases accuracy and reliability of your system through regular cleansing and validation procedures.

* Ensuring data privacy compliance helps your business adhere to regulations like GDPR and HIPAA as well as protecting sensitive customer information.

* Defining data access controls and security measures control user rights for your employees and prevents unauthorized access to corporate data.

Data classification and metadata management help your business categorize data for effective oversight, while data lifecycle management ensures responsible handling of corporate data from creation to deletion. By engaging stakeholders, you promote transparency and trust in your company, and designating data stewards ensures accountability and integrity in your corporate practices. Performance metrics helps measure and improve governance efforts, complemented by training programs to educate employees on principles of compliance. Implementing a robust set of incident response protocols is crucial for monitoring data as well as addressing the fallout from any data breaches. These capabilities working in concert help your business establish robust governance frameworks that protect your customer data and enhance public trust in the insurance sector.