Organizations today invest millions in data tools, cloud storage, analytics platforms, and specialized teams. However, even with all this investment, some fail to answer a critical question: What is the measurable return on data investment? In an era where AI readiness, agility, and real-time decision-making are essential, understanding data strategy ROI has become a non-negotiable for the C-suite.

A strong data strategy involves more than just technology or governance, it entails unlocking tangible business value from data. Read on as we unpack how decision-makers can define, measure, and optimize the return on data investment through a focused, strategic approach.

What Is a Data Strategy—and Why It Matters?

Definition of a Data Strategy

A data strategy is more than just a plan to manage data—it’s a comprehensive framework that defines how an organization collects, stores, manages, and uses data to achieve business objectives. A robust data strategy ensures that data is not only accessible and secure but also trustworthy, governed, and aligned with your organization’s vision.

When properly implemented, a data strategy empowers teams to make informed decisions, fosters innovation through data-driven insights, and improves operational efficiency. It also ensures that your investments in analytics, platforms, and tools are aligned with long-term goals, rather than fragmented or reactionary.

Without a clear data strategy, organizations often react to short-term data issues, suffering from siloed data, inconsistent definitions, and lack of accountability. These inefficiencies limit the ROI of data initiatives and erode stakeholder confidence.

To truly understand the components of a successful strategy—including data governance, architecture, analytics, and security—read our in-depth guide: What Is a Data Strategy?

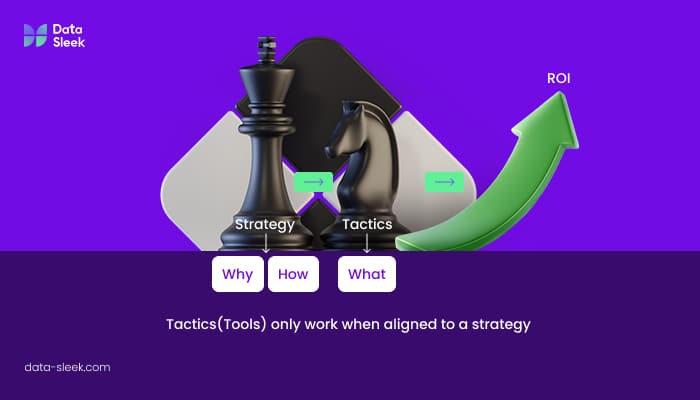

Strategy vs. Tactics: Why Data Tools Alone Don’t Deliver ROI

One common mistake that organizations make is confusing tactics with strategy. Leaders often invest in new platforms, systems, machine learning tools, or dashboards, expecting immediate returns. However, without a guiding data strategy, these tools can’t deliver lasting business value.

Instead, what drives data strategy ROI is the implementation of these tools into a business-wide framework. The return comes from using data to streamline processes, inform decisions, and unearth new opportunities.

Take an example of a CRM platform. It’s only valuable as the consistency and quality of the customer data it contains. Therefore, without clear data ownership, governance, and processes to ensure accuracy, even the most advanced systems will produce poor results.

Therefore, the strategy helps define “why” and “how”. Tools, on the other hand, enable the “what”. Companies that approach data with a strategic mindset enjoy higher returns on their investments compared to those going after the latest technology and tools without alignment.

The Business Case: ROI of a Data Strategy

A well-crafted data strategy is more than a technical necessity, it’s a financial asset. Companies that invest in data strategy can see measurable returns in multiple business facets. This can either be through unlocking new revenue opportunities, lowering operational costs, or reducing regulatory risks. Here are more key areas where companies can realize a strong data ROI.

Cost Savings from Better Data Practices

One of the most immediate benefits of a strong data strategy is cost savings. Poor data management leads to data silos, duplicate entries, or even manual reconciliations. This bloats operations and leads to expensive inefficiencies. In fact, according to Harvard Business Review, IBM estimated that bad data costs the U.S. economy $3.1 trillion annually. Construction executives can see these cost savings in practice — explore the specific ROI builders achieve when consolidating fragmented project data into a unified system.

Fortunately, when the data is governed centrally and accessed through a unified architecture, it eliminates all these issues. These improvements translate to lower direct costs and reduce the burden on operations and IT teams.

Revenue Growth Through Smarter Decisions

Besides cutting costs, data can also help fuel business growth. A well-informed data strategy enables better decisions across the company. For example, with a strategic approach to data, marketing departments can improve campaign targeting and attribution.

Having access to clean, integrated data enables companies to reduce churn, identify upsell opportunities, and predict customer behavior. Such data-driven insights contribute directly to revenue growth.

Operational Efficiency & Time Savings

In any competitive market, speed matters. With a sound data strategy, organizations can accelerate the time it takes to turn raw data into actionable insights. This can allow for automated workflows, self-serve analytics, and even time savings when searching or verifying data.

Having these efficiencies in place enables the team to focus on higher-value tasks like customer service, innovation, or strategic planning. They also lead to faster, more reliable decision-making, ensuring that the ROI of data strategy compounds over time.

Compliance & Risk Mitigation

Data-related regulations are becoming more complex and stricter. Whether it’s HIPAA, GDPR, or industry-specific standards, non-compliance can lead to reputational damage, legal exposure, and fines.

With a proactive data strategy, companies can embed access control, governance, and auditability from the ground up. This helps minimize risk, both financial and operational, by reducing reporting errors, streamlining compliance efforts, and avoiding breaches.

Quantifying the ROI: How to Measure It

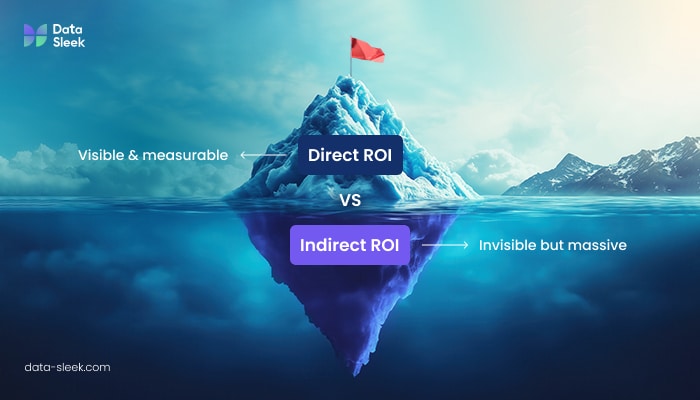

Direct ROI vs. Indirect ROI

When evaluating the return on investment (ROI) of a data strategy, it’s not enough to only focus on the money saved or made. Instead, successful organizations understand that ROI comes in two forms: direct and indirect.

Direct ROI refers to the measurable and immeasurable financial gains resulting from executing a data strategy. These are the numbers that decision-makers often require. They include:

- Time saved through faster reporting or automation

- Reduction in data management and IT costs

- Decreased compliance penalties thanks to better data governance

- Increased sales through more accurate targeting

Indirect ROI, on the other hand, is harder to measure, but it’s equally valuable since the returns compound over time. This is where the missed opportunities live. This means that organizations must ensure that data gets to the right place at the right time to ensure they don’t lose value. Some examples include:

- Enhanced customer trust due to compliant and secure data use

- Faster decision-making, thus improving responsiveness to market changes

- Improved AI model accuracy, which boosts personalization and automation

KPIs to Track

To quantify the ROI of a data strategy, organizations must have a clear, structured approach to measure performance. By having the right key performance indicators (KPIs), organizations can turn vague data goals into concrete business value. Finance leaders should also track industry-specific finance KPIs like Return on Equity, Net Interest Margin, and Customer Acquisition Cost. Some of the KPIs that serve as the foundation for measuring the impact of a data strategy include:

- Time to Data Access: How quickly can someone retrieve accurate, usable data?

- Report Turnaround Time: Are data insights delivered in minutes or days?

- Cost per Insight: What is the cost, in resources and time, of generating a useful insight?

- Service Level Agreement (SLA) Compliance: Is the data team delivering on company expectations consistently?

- Number of Manual Tasks Automated: How many hours of repetitive work have been eliminated?

- Data Trust Score: How confident are users in the completeness and accuracy of data based on audits or surveys?

Tracking these KPIs before and after implementing a data strategy can help highlight the delta. In return, decision-makers can justify the continued investment.

ROI Calculation Formula

Most business leaders know that data is valuable, however, only a few know how to quantify that value in business terms. Without a clear formula, data initiatives can end up being cost centers rather than efficiency or revenue drivers. To prove that a data strategy is delivering measurable returns, organizations need a standardized ROI formula. With the formula:

ROI = (Financial Benefit – Data Strategy Cost) ÷ Data Strategy Cost.

Therefore, if a business has the annual value of time saved at $500,000 and the cost of implementing a data strategy at $200,000, the ROI would be:

($500,000 – $200,000) ÷ $200,000 = 1.5 or 150%

While organizations can capture visible ROI with this formula, they can also expand it to include forecasted opportunity gains like customer retention improvements or uplifts from AI enablement.

ROI from Master Data Management (MDM)

Master Data Management (MDM) is an overlooked source of high-impact ROI data. While some might consider it an IT function, MDM is a strategic asset that can power better customer experiences, faster decisions, and scalable automation.

Without MDM, data remains fragmented across teams and departments, leading to duplicate efforts, inconsistent insights, and preventable revenue loss. Fortunately, implementing MDM can help organizations gain a unified, trusted version of key data across departments. This consistency allows ROI master data management to come to life. With reliable MDM:

- Sales and marketing teams can avoid wasted outreach due to incomplete or duplicate customer records.

- AI and automation efforts can perform better since they’re trained on stable, structured inputs rather than fragmented or flawed data.

- Finance gains confidence in consolidated reporting without spending weeks reconciling mismatched data.

- Regulatory audits become faster and less risky thanks to well-governed and clearly defined master records.

Curious about how much value your current data stack is really delivering? Speak with a data expert today.

Real-World Examples of Data Strategy ROI

Example 1: Manufacturing Company Improves Forecasting Accuracy

A global manufacturer faced significant challenges due to inconsistent forecasting. Different tools and varying data definitions across teams led to conflicting numbers and missed demand signals. The result was overproduction in some markets and shortages in others.

To address these issues, the manufacturer implemented a unified data strategy. This strategy had three key pillars: a cloud data warehouse (Snowflake), central data governance, and cross-functional collaboration between finance, IT, and operations.

Within six months, forecast accuracy improved significantly, mirroring Snowflake’s own customer successes, which noted improvements of 8-15% in forecasting accuracy after migrating to their unified platform. This also led to more efficient production scheduling, a reduction in excess inventory, and better raw material planning.

Example 2: Retailer Saves $500K via Inventory Optimization

A mid-sized retailer was facing challenges with outdated stock and excess inventory. This hurt the company’s sales and tied up cash. Since the retailer’s data was fragmented across several legacy systems, it led to limited visibility and inconsistent product information.

To rectify the issues, the retailer adopted a data strategy focusing on centralized sales data and inventory using Amazon S3 for storage, Amazon Redshift for analytics, and AWS Glue for data integration. This helped create a unified, real-time view of the retailer’s inventory.

With the newly clean, consolidated data, the retailer optimized inventory levels through enhanced analytics. This led to a direct reduction in carrying costs and markdowns, resulting in $500,000 in direct cost savings within a single year.

According to McKinsey, implementing AI-based forecasting can improve forecasting accuracy by 10–20%, leading to revenue increases of 2–3%. This approach also aids in determining ideal inventory levels and better predicting the impact of sales promotions.

Example 3: SaaS Company Reduces Reporting Time by 60%

A fast-growing SaaS company had a common problem: its reporting processes were slow, manual, and inconsistent across various departments. Sales, finance, and product teams each pulled data from different sources. This led to delays, conflicting numbers during executive reviews, and duplicated work.

To resolve this, the company implemented a cloud-first data strategy, migrating core data sources into Google BigQuery and applying robust role-based access controls via Looker. This move provided every department with a single source of true and accessible data.

As a result, reporting time decreased by 60%. Sales leaders had faster visibility into pipeline performance, finance teams spent less time on data reconciliation, and product teams could act on usage metrics within hours instead of days.

This significant efficiency gain mirrored outcomes seen in similar BigQuery implementations; for instance, Kensington, working with Google Cloud, reduced monthly reporting from 40 hours to just minutes. The result? A clear example of data ROI where speed unlocks: faster experiments, faster decision-making, and faster course corrections.

What Happens When You Don’t Have a Data Strategy?

For most organizations, the lack of a data strategy never feels like an urgent problem until the symptoms appear. Confused teams, disconnected systems, and stalled initiatives all lead back to the same root cause: data chaos. Without a guiding data strategy, even investments in tools or talent fail to generate full returns.

The Cost of Missed Opportunities

While AI and machine learning promise transformation, they can’t deliver without well-governed and reliable data. Building a predictive engine on inconsistent or fragmented imports leads to flawed recommendations, or worse, decisions that can hurt an organization.

Fortunately, a strong data strategy ensures AI and ML investments are grounded in trusted data pipelines. Without it, organizations leave out competitive advantages like personalization, automation, or effective forecasting on the table.

Data Chaos = Poor Decision-Making

If each team in an organization builds its definitions, dashboards, and metrics, decision-making slows down, often steering the organization in the wrong direction. Analytics waste their time reconciling conflicting data, while leaders receive reports based on misaligned or outdated KPIs.

This leads to strategy paralysis, something a centralized data strategy can avoid. A centralized data strategy guarantees consistency, aligns teams on data definitions, and shortens time to insight.

Shadow IT and Silos Lead to More Spend

Without a unified data strategy, departments and teams often end up using their systems and tools. For example, marketing may use one platform while operation uses another. This results in duplication, budget sprawl, and integration headaches.

This siloed approach drives up internal spending on tools and systems without providing any meaningful value. Furthermore, it erodes trust in data within the organization. A data strategy, fortunately, fosters collaboration, reduces redundancy, and increases the return on data investment within the company.

Building a Strategy That Delivers ROI

Creating a data strategy that brings value to an organization is more than just chasing buzzwords or piling on tools. It requires alignment, intention, and execution.

Align with Business Goals

An effective data strategy starts with the business instead of the infrastructure. Whether an organization aims to reduce supply chain costs, improve customer retention, or accelerate market expansion, a data strategy must map directly to these outcomes.

Therefore, the strategy identifies what a business needs to achieve and how data can support those goals. Aligning data efforts with organizational objectives ensures measurable and visible ROI. That’s because data is at the forefront of the organization’s success instead of operating in the background.

Focus on Use Cases, Not Tools

Nowadays, most companies fall into the trap of investing in expensive systems and tools without a clear plan of how to use them. They fail to understand that a tool alone can’t deliver value unless it solves a real problem.

A strong data strategy is built around high-impact use cases like predictive maintenance, faster financial reporting, fraud detection, or personalized customer journeys. These use cases showcase how data is used, thus providing the business with tangible ROI. Focusing on use cases first enables organizations to avoid tech sprawl and prioritize solutions.

Invest in the Right Team & Partner

While a business strategy helps identify business goals and outline how to meet them, it’s no good without the right platforms and teams. For a data strategy to succeed, organizations must build cross-functional teams that view data as a strategic asset.

Furthermore, organizations must have reliable, scalable infrastructure like Snowflake, AWS, Google BigQuery, or SAP. Such platforms support the necessary security, governance, and scalability required to turn data into decisions.

How Data Sleek Helps You Maximize Data Strategy ROI

For most organizations, data isn’t only an asset, it’s a core driver of competitive advantage. As highlighted above, the ROI of data strategy includes improved forecasting, cost reduction, AI readiness, and faster decisions. Unfortunately, most organizations struggle with siloed systems, misaligned tools, and a lack of clear use cases.

Data Sleek addresses these challenges by aligning data with business goals. Through services like data management, data architecture, and data strategy consulting, our team helps organizations unlock automation, reduce duplication, and ensure reliable data flow across departments. With cross-industry expertise and a hands-on approach, Data Sleek helps organizations manage data and realize the return on data investment.

Don’t let poor data decisions cost you more. Schedule your free consultation and build a strategy that pays off.

FAQ Section:

How do you measure data ROI?

To measure data ROI, organizations must compare operational and financial benefits from data initiatives against the total cost of the initiatives. Therefore, organizations should compare direct and indirect benefits using this common formula:

(Financial Benefit – Data Strategy Cost) ÷ Data Strategy Cost = ROI

Example: If a company automates a reporting process, saving 3,000 staff hours annually (worth $150,000) and spends $50,000 on the automation system, the ROI would be (150,000 – 50,000) ÷ 50,000 = 2.0 or 200%.

Why is master data management important for ROI?

Master Data Management (MDM) helps ensure that critical company data, like product, customer, and vendor information, is consistent, clean, and accessible across platforms. This data consistency eliminates duplication and confusion, enabling efficient operations, accurate reporting, and effective decision-making.

Example: A retailer without MDM might have five different entries for the same customer across different systems. This can result in redundant marketing emails, poor personalization, and misleading customer insights. MDM unifies these records, improving campaign effectiveness and reducing costs.

Difference between Data ROI and Data Strategy ROI?

Data ROI refers to the measurable gains from specific data use cases. This includes reduced costs through automation or increased revenues from targeted marketing. Data strategy ROI includes the broader organizational benefits of infrastructure, processes, and people. This includes investment in skilled talent, data architecture, governance, and processes that make those use cases possible.

Example: If a predictive analysis model drives $1M in upsell revenue, that’s a clear case of data ROI. But if the strategy that enabled data standardization, hiring data engineers, and setting up pipelines made that possible, the return from all those foundational efforts is your data strategy ROI.

What role does cost savings play in calculating my overall data strategy ROI?

Cost savings are often the most immediate and visible component of data strategy ROI. They highlight how better data practices reduce inefficiency, redundancy, and waste across the organization. These savings can come from various areas, like eliminating duplicate data storage, consolidating tools to reduce licensing costs, or decreasing error-related rework across teams.

Example: If a mid-sized retailer adopts a centralized data strategy, utilizing systems like Redshift for analytics, AWS S3 for storage, and Glue for integration, they can eliminate excess inventory and outdated stock. With a unified view of sales and product data, the retailer can reduce markdowns and carrying costs, leading to $500,000 in annual savings. These savings reflect the organization’s ROI in data governance and infrastructure.

How do I evaluate long-term ROI from master data management projects?

MDM projects often require large upfront investments in governance, tools, and cross-functional coordination. But the long-term ROI comes from reduced manual effort, improved data consistency, and more effective decision-making across the organization. To evaluate long-term ROI, track gains in operational efficiency over time, reductions in error-related costs, and improvements in reporting accuracy.

Example: If a global manufacturer invests in an MDM solution to standardize product and supplier data across regions, the payoff may not be immediate. However, over the next 12 to 18 months, the organization could cut down procurement delays, reduce duplicate supplier records, and improve demand forecasting. These improvements contribute to sustained ROI over the years, saving money and supporting faster production cycles.

What are the most effective methods to quantify data strategy ROI in my organization?

To quantify data strategy, organizations should start by aligning data initiatives to individual goals. Some effective methods include measuring revenue uplift from improved analytics, reduced risk exposure through better compliance, and time saved on reporting.

Example: If a SaaS company implements a new data strategy by consolidating data sources into a cloud warehouse and introducing access controls, their reporting times may drop by 60%. Such efficiency enables sales and finance teams to reallocate hundreds of hours annually to strategic work. This translates into faster decision-making and labor cost savings, demonstrating the long-term ROI of an organization’s data strategy.