Key Highlights

- The insurance industry thrives on data, utilizing it for critical functions from underwriting policies to managing claims.

- Effective data management is crucial for insurance companies to make informed decisions, optimize pricing, and enhance customer service.

- However, insurers face challenges in handling vast and diverse datasets, ensuring data quality, and complying with stringent regulations.

- Implementing robust data management practices and technology solutions can empower insurers to overcome these hurdles.

- By leveraging the power of data, insurance companies can enhance operational efficiency, optimize risk assessment, deliver personalized customer experiences, and maintain a competitive edge.

Introduction

In today’s age of rapid digital transformation, the insurance industry faces an increasing need for robust data management. With the industry becoming more data-driven, insurance companies gather vast amounts of information from diverse sources. Implementing effective data management strategies is no longer optional; it’s vital for success. In this digital era, it is crucial for insurance companies to establish robust data management practices to harness the full potential of their data.

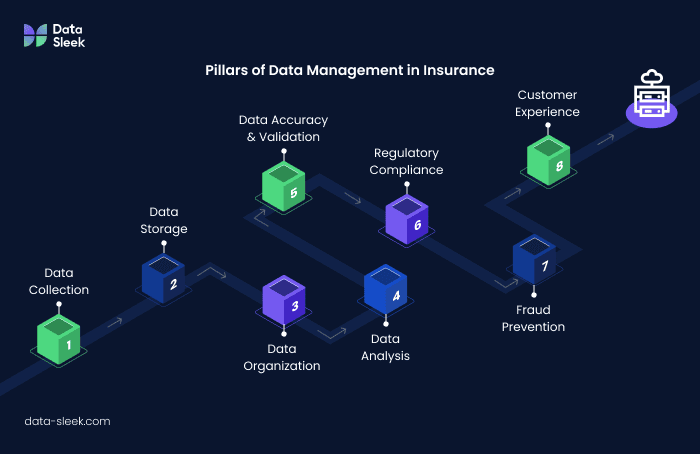

Exploring the Pillars of Data Management in Insurance

Effective data management within the insurance industry rests on several key pillars, each crucial for maximizing the value of data. It involves the collection, storage, organization, and analysis of information in a way that allows for informed decision-making and process optimization. This involves implementing secure and efficient methods for data collection, storage, and processing.

Another essential aspect is ensuring data accuracy and reliability through rigorous validation and cleansing processes. This is essential to minimize errors, reduce risk, and comply with regulatory requirements.

The significance of accurate data collection

Data quality is paramount in the insurance industry, and it all begins with accurate data collection. Insurance companies gather information from various sources, including application forms, external databases, and third-party providers. Ensuring the accuracy and completeness of this data is essential for informed decision-making throughout the insurance lifecycle.

Accurate data collection enables insurance companies to assess risk effectively, determine appropriate premiums, and prevent fraudulent activities. It also forms the foundation for providing personalized customer experiences, as incomplete or inaccurate data can lead to misunderstandings and dissatisfaction.

To maintain high data quality, insurers must prioritize data validation and verification processes during the collection stage. This may involve implementing automated checks, standardizing data entry procedures, and leveraging data quality tools to identify and rectify discrepancies promptly.

Ensuring data integrity and security

Data integrity and security are non-negotiable in the insurance sector, which handles vast amounts of sensitive customer information. Implementing robust security measures is essential to protect data from unauthorized access, breaches, and cyber threats.

Effective risk management in data security involves a multi-layered approach. This includes implementing access controls to restrict data access to authorized personnel only. Regularly updating security protocols and software is crucial to address emerging threats and vulnerabilities.

Insurance companies must also prioritize employee training on data security best practices and raise awareness about potential risks. By adopting a comprehensive approach to data security, insurance companies can protect customer data, maintain compliance, and safeguard their reputation.

Overcoming Challenges in Insurance Data Management

While the importance of data management in insurance is undeniable, insurance companies often face challenges in implementing effective strategies. A key challenge is navigating the complex regulatory landscape. The insurance sector is subject to stringent regulations regarding data privacy and security.

Additionally, maintaining data quality and consistency across different systems and sources can be difficult, particularly for companies with legacy systems. However, addressing these challenges is essential for harnessing the actual power of data for enhanced decision-making and customer-centric solutions.

Navigating through regulatory compliance hurdles

The insurance sector operates within a strict regulatory environment, with multiple legal requirements governing data privacy, security, and reporting. Complying with regulations such as GDPR, CCPA, and HIPAA is not only ethically imperative but also essential for avoiding legal repercussions and reputational damage.

To successfully navigate these requirements, insurance companies must implement robust data governance frameworks that outline clear policies and procedures for data handling. This includes establishing data retention policies, ensuring data accuracy, and facilitating secure data storage and disposal methods.

Regular audits and risk assessments can help identify potential compliance gaps and allow for timely remediation. A proactive approach to regulatory compliance is vital for maintaining customer trust and ensuring the long-term sustainability of insurance businesses.

Addressing data quality and consistency issues

Maintaining data quality and consistency can be a significant hurdle for insurance companies dealing with data from various sources and systems. Poor data quality can result in inaccurate risk assessments, flawed underwriting decisions, and a negative impact on customer service.

To address these issues, implementing data quality management processes is essential. This involves data profiling to understand data patterns and identify inconsistencies, followed by data cleansing and standardization to correct errors and unify data formats.

Utilizing master data management (MDM) solutions can help create a single, trusted view of critical data entities, such as customer and policy information. By prioritizing data quality and consistency, insurance companies can ensure reliable analytics, streamline operations, and improve decision-making.

Leveraging Technology for Enhanced Data Management

Technology plays an increasingly significant role in addressing data management challenges and enabling insurers to extract actionable insights. Adopting advanced technology can revolutionize how insurance companies manage and leverage data.

Tools such as cloud-based data platforms, AI, machine learning, and blockchain are transforming data management, enabling greater efficiency, security, and analytical capabilities. These technologies empower insurers to move beyond traditional data management approaches and unlock new possibilities for growth and innovation.

The role of AI and Machine Learning in data analysis

Artificial intelligence and machine learning are transforming data analysis in the insurance industry. These technologies offer powerful capabilities for pattern recognition, anomaly detection, and predictive modeling, enabling insurers to extract more value from their data.

Machine learning algorithms can analyze vast datasets to identify patterns and trends that humans might overlook, leading to more accurate risk assessments, personalized pricing, and proactive fraud detection. Chatbots and virtual assistants powered by AI can enhance customer interactions, providing instant support and personalized recommendations.

As AI and ML technologies continue to evolve, their applications within the insurance sector are expected to expand. By embracing these tools, insurers can automate tasks, gain deeper insights from their data, and enhance overall operational efficiency.

Blockchain for data security and fraud prevention

Blockchain technology presents a significant opportunity to enhance data security and combat fraud in the insurance industry. Blockchain’s decentralized and immutable nature makes it highly resistant to data breaches and unauthorized modifications, improving data integrity and building trust with customers.

In fraud prevention, blockchain can help create secure and transparent records of transactions, making it challenging for fraudulent activities to go undetected. For instance, using blockchain for claims processing can reduce the risk of fraudulent claims and streamline the settlement process, benefiting both insurers and policyholders.

While blockchain technology is still evolving within the insurance sector, its potential applications for data security, fraud prevention, and improved transparency are immense. Early adoption of blockchain solutions can provide insurers with a competitive edge in an increasingly data-driven and security-conscious market.

The Impact of Effective Data Management on Customer Experience

In today’s competitive business environment, delivering exceptional customer experiences is paramount. This is particularly true in the insurance industry, where customer expectations are evolving rapidly. Effective data management is no longer just about back-end efficiency; it’s become a key driver of enhanced customer experiences.

By leveraging data insights, insurance companies can transform their interactions with customers, from the initial point of contact to policy renewal and beyond. This customer-centric approach fosters trust, loyalty, and, ultimately, long-term success for insurance providers.

Personalized insurance offerings through data insights

The ability to tailor products and services to individual customer needs is a significant differentiator in today’s competitive insurance market. By effectively utilizing customer data, insurance companies can transition from generic offerings to personalized insurance solutions.

Analyzing customer data such as demographics, lifestyle choices, and risk profiles allows insurers to gain actionable insights into individual preferences and requirements. This empowers them to design insurance policies that align precisely with the specific needs of a customer, ultimately increasing customer satisfaction and retention.

Personalized insurance offerings can include usage-based insurance, customized policy bundles, and tailored risk mitigation advice. Creating personalized experiences demonstrates a deep understanding of customer needs, fostering loyalty and enhancing brand reputation.

Streamlining claims processing with better data management

The claims process is a crucial touchpoint in the customer journey, and efficient claims handling can significantly impact customer satisfaction. By optimizing data management practices, insurers can streamline the entire process, making it faster, more transparent, and hassle-free for policyholders.

Efficient claims processing relies on seamless data flow between different systems and stakeholders involved in the claim settlement. Automating manual tasks, such as data entry and verification, can expedite the process while reducing errors. Real-time data accessibility empowers claims adjusters to make faster and more informed decisions, resulting in quicker settlements and increased customer satisfaction.

Furthermore, leveraging data analytics can help detect and prevent fraudulent claims, safeguarding both the insurer and genuine policyholders. An efficient and customer-centric claims process is essential for building trust and strengthening customer relationships.

Future Trends in Insurance Data Management

As the insurance industry continues to evolve, data management practices must adapt to meet emerging trends and challenges. With advancements in technology and a greater focus on customer-centricity, the future of data management is likely to be shaped by several key trends.

These trends will redefine how insurers collect, manage, analyze, and leverage data, further emphasizing the need for flexible, scalable, and secure data management solutions.

Predictive analytics shaping insurance policies

Predictive analytics is playing an increasingly pivotal role in shaping insurance policies and revolutionizing how insurers assess and manage risk. Utilizing historical data, statistical algorithms, and machine learning techniques enables insurers to predict future outcomes with greater accuracy.

In risk assessment, predictive analytics can help identify high-risk individuals or groups based on various factors, enabling insurers to adjust premiums and coverage accordingly. Moreover, predictive models can assist in fraud detection by analyzing historical patterns and identifying anomalies in claims data.

By leveraging predictive analytics, insurers can move from a reactive to a proactive approach, mitigating risks more effectively, optimizing pricing strategies, and developing more relevant insurance products. This ultimately benefits both insurers and policyholders, leading to a more stable and sustainable insurance ecosystem.

The evolution towards digital-first insurance processes

The insurance business is undergoing a significant digital transformation, with companies increasingly adopting digital-first processes across various operational areas. From online policy applications and digital claims filing to automated underwriting processes and personalized customer portals, the shift towards digitization is reshaping the industry.

This digital transformation relies heavily on robust data management practices. To support digital-first processes, insurance companies need to ensure seamless data flow, data quality, and accessibility across various touchpoints. Cloud-based data platforms and application programming interfaces (APIs) facilitate real-time data exchange and integration, enabling seamless customer interactions and efficient operations.

As digital adoption accelerates, insurers must prioritize data security and privacy to protect sensitive customer information. Implementing robust cybersecurity measures and adhering to data protection regulations is crucial for maintaining customer trust in an increasingly digital insurance landscape.

Conclusion

In conclusion, effective data management in the insurance industry is crucial for accurate risk assessment, enhanced customer experience, and fraud prevention. By ensuring data integrity, security, and leveraging cutting-edge technologies like AI and blockchain, insurers can streamline processes and offer personalized services. Embracing predictive analytics and digital-first approaches will shape the future of insurance data management, driving innovation and efficiency. To stay ahead in this dynamic landscape, insurers must prioritize data quality, regulatory compliance, and technological advancements to meet evolving customer needs and industry demands. If you seek to elevate your data management practices, implementing these strategies can propel your insurance business towards success.

Frequently Asked Questions

How does data management improve risk assessment in insurance?

Effective data management enables the insurance industry to leverage data analytics for improved risk management. Data integration from various sources allows for comprehensive risk assessment by providing a holistic view of policyholders and potential risks, resulting in more accurate underwriting decisions.

What are the main challenges in managing insurance data?

The insurance sector faces challenges managing vast amounts of data, ensuring data quality, and complying with evolving regulatory requirements related to data privacy. Additionally, legacy systems and data silos often hinder effective data integration and analysis.

Can data management reduce insurance fraud?

Robust data management systems, combined with strong data governance practices, enhance fraud prevention in the insurance industry. Improved data accuracy and data management systems help identify patterns, anomalies, and potential fraudulent activities more effectively.

How does technology impact insurance data management?

Technology significantly impacts insurance data management. Software solutions, such as master data management platforms and advanced analytics tools, enable data integration, improve operational efficiency, and facilitate more accurate decision-making.

What steps can insurers take to enhance their data management practices?

To enhance data management practices, insurers should prioritize data validation, establish robust data governance frameworks, improve data accessibility for policy administration, and align data strategies with evolving customer expectations.